850 Shade Tree Way Corona, CA 92880

North Corona NeighborhoodEstimated Value: $661,000 - $690,000

3

Beds

3

Baths

1,357

Sq Ft

$499/Sq Ft

Est. Value

About This Home

This home is located at 850 Shade Tree Way, Corona, CA 92880 and is currently estimated at $676,984, approximately $498 per square foot. 850 Shade Tree Way is a home located in Riverside County with nearby schools including Parkridge Elementary, Auburndale Intermediate, and Norco High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 22, 2004

Sold by

Gowin James R and Gowin Tina

Bought by

Villalobos Reynaldo and Rodriguez Jennifer

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$293,600

Outstanding Balance

$146,379

Interest Rate

5.87%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$530,605

Purchase Details

Closed on

Nov 5, 1997

Sold by

Beazer Homes Holdings Corp

Bought by

Gowin James R and Gowin Tina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,827

Interest Rate

7.23%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Villalobos Reynaldo | $367,000 | First American Title Co | |

| Gowin James R | $136,500 | Investors Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Villalobos Reynaldo | $293,600 | |

| Previous Owner | Gowin James R | $138,827 | |

| Closed | Villalobos Reynaldo | $73,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,626 | $511,544 | $174,228 | $337,316 |

| 2023 | $5,626 | $491,681 | $167,463 | $324,218 |

| 2022 | $5,448 | $482,041 | $164,180 | $317,861 |

| 2021 | $5,341 | $472,590 | $160,961 | $311,629 |

| 2020 | $4,772 | $422,053 | $143,541 | $278,512 |

| 2019 | $4,618 | $409,760 | $139,360 | $270,400 |

| 2018 | $4,429 | $394,000 | $134,000 | $260,000 |

| 2017 | $3,998 | $357,000 | $122,000 | $235,000 |

| 2016 | $3,926 | $347,000 | $118,000 | $229,000 |

| 2015 | $3,821 | $340,000 | $116,000 | $224,000 |

| 2014 | $3,702 | $335,000 | $114,000 | $221,000 |

Source: Public Records

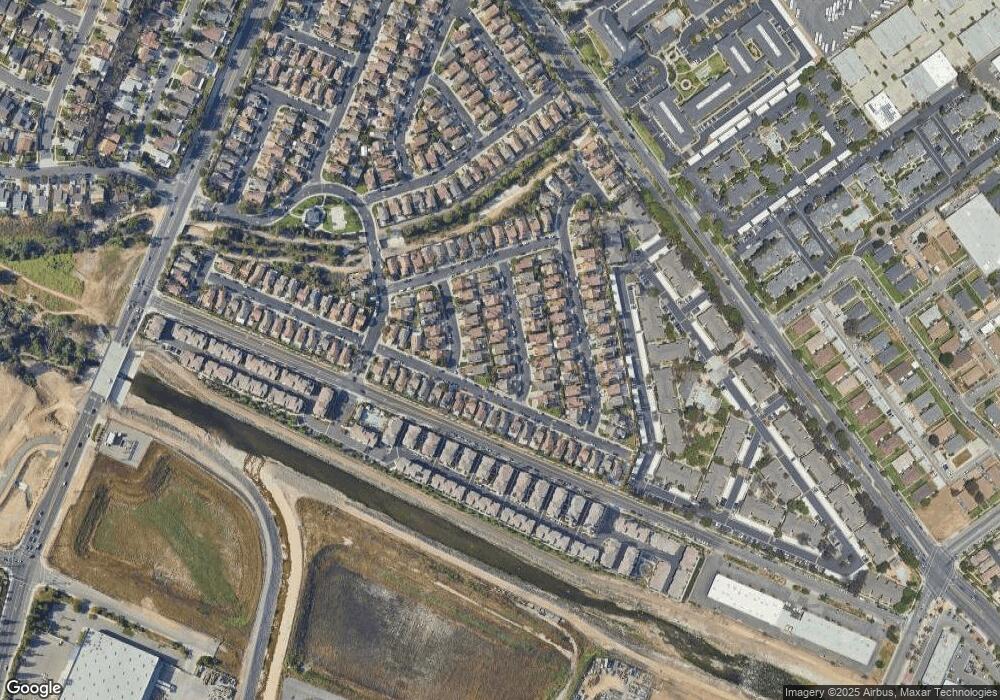

Map

Nearby Homes

- 868 Pathfinder Way

- 823 Pathfinder Way

- 677 Savi Dr Unit 103

- 929 Pinecone Dr

- 893 Tangelo Way Unit 103

- 893 Tangelo Way Unit 101

- 1017 Savi Dr Unit 103

- 483 Klamath St

- 826 Railroad St

- 222 N Buena Vista Ave

- 936 Auburndale St

- 1775 Acre St

- 134 N Cota St

- 995 Pomona Rd Unit SPC 11

- 995 Pomona Rd Unit 41

- 995 Pomona Rd Unit 88

- 995 Pomona Rd Unit 65

- 515 Corona Cir

- 112 N Merrill St

- 1474 Greenbriar Ave

- 856 Shade Tree Way

- 844 Shade Tree Way

- 862 Shade Tree Way

- 838 Shade Tree Way

- 853 Honey Grove Way

- 847 Honey Grove Way

- 859 Honey Grove Way

- 868 Shade Tree Way

- 832 Shade Tree Way

- 855 Shade Tree Way

- 849 Shade Tree Way

- 865 Honey Grove Way

- 861 Shade Tree Way

- 843 Shade Tree Way

- 867 Shade Tree Way

- 874 Shade Tree Way

- 837 Shade Tree Way

- 871 Honey Grove Way

- 873 Shade Tree Way

- 831 Shade Tree Way