8896 David Place Unit 201A Des Plaines, IL 60016

Estimated Value: $194,000 - $211,444

--

Bed

--

Bath

--

Sq Ft

0.31

Acres

About This Home

This home is located at 8896 David Place Unit 201A, Des Plaines, IL 60016 and is currently estimated at $204,361. 8896 David Place Unit 201A is a home located in Cook County with nearby schools including Washington Elementary School, Gemini Middle School, and Maine East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 12, 2023

Sold by

Patel Ketan and Patel Jagruti

Bought by

Patel Ketan and Patel Jagruti

Current Estimated Value

Purchase Details

Closed on

Aug 13, 2022

Sold by

Binymen Odisho

Bought by

Patel Ketan and Patel Jagruti

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

5.13%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 28, 2003

Sold by

Hoszkiewicz Stanislaw and Hoszkiewicz Anna

Bought by

Pourana Avdisho

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,200

Interest Rate

5.96%

Purchase Details

Closed on

Aug 27, 1996

Sold by

Young Lee Kwang Ho and Young Lee Sul

Bought by

Hoszkiewicz Stanislaw and Hoszkiewicz Anna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,250

Interest Rate

8.3%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Patel Ketan | -- | None Listed On Document | |

| Patel Ketan | $164,500 | None Listed On Document | |

| Pourana Avdisho | $146,500 | Pntn | |

| Hoszkiewicz Stanislaw | $75,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Patel Ketan | $100,000 | |

| Previous Owner | Pourana Avdisho | $117,200 | |

| Previous Owner | Hoszkiewicz Stanislaw | $71,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,883 | $15,025 | $630 | $14,395 |

| 2023 | $3,690 | $15,025 | $630 | $14,395 |

| 2022 | $3,690 | $15,025 | $630 | $14,395 |

| 2021 | $3,216 | $10,761 | $969 | $9,792 |

| 2020 | $3,143 | $10,761 | $969 | $9,792 |

| 2019 | $3,091 | $12,042 | $969 | $11,073 |

| 2018 | $2,453 | $8,429 | $848 | $7,581 |

| 2017 | $2,412 | $8,429 | $848 | $7,581 |

| 2016 | $1,586 | $8,429 | $848 | $7,581 |

| 2015 | $1,397 | $7,406 | $727 | $6,679 |

| 2014 | $1,364 | $7,406 | $727 | $6,679 |

| 2013 | $1,324 | $7,406 | $727 | $6,679 |

Source: Public Records

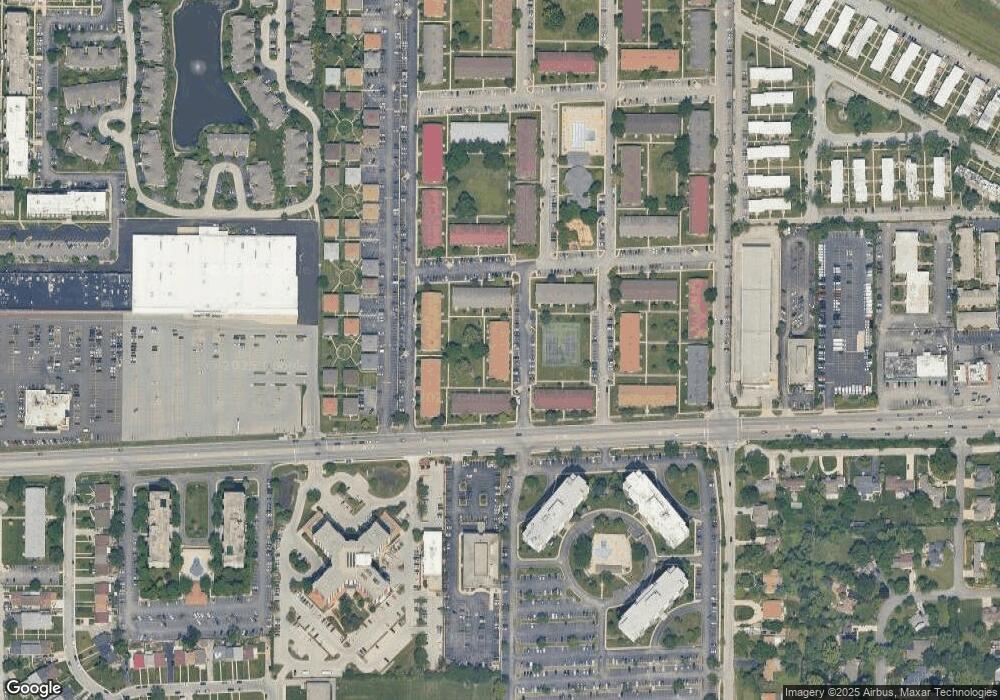

Map

Nearby Homes

- 8896 David Place Unit 2E

- 8872 Jody Ln Unit 2E

- 8904 Jody Ln Unit 1C

- 8804 Golf Rd Unit 2F

- 8815 W Golf Rd Unit 6D

- 9009 Golf Rd Unit 2A

- 8809 W Golf Rd Unit 11F

- 8809 W Golf Rd Unit 10C

- 9001 Golf Rd Unit 5B

- 8936 Northshore Dr Unit 104D

- 9026 W Heathwood Cir Unit C1

- 9532 Greenwood Dr

- 9074 W Terrace Dr Unit 4N

- 8663 Gregory Ln Unit 10

- 9098 W Terrace Dr Unit 1L

- 9078 W Heathwood Dr Unit 5

- 9588 Terrace Place Unit 1C

- 9501 Terrace Place

- 9701 N Dee Rd Unit 5E

- 9701 N Dee Rd Unit 2I

- 8896 David Place Unit 1F

- 8896 David Place Unit 1G

- 8896 David Place Unit 204D

- 8896 David Place Unit 206F

- 8896 David Place Unit 207G

- 8896 David Place Unit 205E

- 8896 David Place Unit 101A

- 8896 David Place Unit 208H

- 8896 David Place Unit 106F

- 8896 David Place Unit 104D

- 8896 David Place Unit 203C

- 8896 David Place Unit 108H

- 8896 David Place Unit 107G

- 8896 David Place Unit 105E

- 8896 David Place Unit 103C

- 8896 David Place Unit 202B

- 8896 David Place Unit 102B

- 8896 David Place Unit 1C

- 8896 David Place Unit 2H