9 Cloverleaf Ct Unit 105 Tehachapi, CA 93561

Estimated Value: $230,858 - $236,000

2

Beds

1

Bath

768

Sq Ft

$304/Sq Ft

Est. Value

About This Home

This home is located at 9 Cloverleaf Ct Unit 105, Tehachapi, CA 93561 and is currently estimated at $233,429, approximately $303 per square foot. 9 Cloverleaf Ct Unit 105 is a home located in Kern County with nearby schools including Cummings Valley Elementary School, Jacobsen Middle School, and Tehachapi High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 6, 2024

Sold by

Ricketts Family Trust and Ricketts Arthur G

Bought by

Carrington Brittany and Vuong Michael

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,600

Outstanding Balance

$214,165

Interest Rate

6.47%

Mortgage Type

New Conventional

Estimated Equity

$19,264

Purchase Details

Closed on

May 4, 2024

Sold by

Cypert Nathan

Bought by

Ricketts Linda

Purchase Details

Closed on

May 3, 2024

Sold by

Ricketts Arthur G and Ricketts Linda

Bought by

Ricketts Family Trust and Ricketts

Purchase Details

Closed on

Jul 20, 2010

Sold by

Teal Randall M

Bought by

Cypert Nathan

Purchase Details

Closed on

Jun 22, 2001

Sold by

Teal Stanton M and Teal Diane K

Bought by

Teal Stanton M and Teal Diane K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carrington Brittany | $228,000 | Chicago Title Company | |

| Ricketts Linda | -- | None Listed On Document | |

| Ricketts Family Trust | -- | None Listed On Document | |

| Cypert Nathan | $45,000 | First American Title Company | |

| Ricketts Linda | -- | First American Title Company | |

| Teal Stanton M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Carrington Brittany | $216,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,336 | $228,000 | $30,000 | $198,000 |

| 2024 | $1,304 | $56,509 | $12,555 | $43,954 |

| 2023 | $1,304 | $55,402 | $12,309 | $43,093 |

| 2022 | $1,290 | $54,317 | $12,068 | $42,249 |

| 2021 | $1,235 | $53,253 | $11,832 | $41,421 |

| 2020 | $1,220 | $52,708 | $11,711 | $40,997 |

| 2019 | $1,220 | $52,708 | $11,711 | $40,997 |

| 2018 | $1,197 | $50,663 | $11,257 | $39,406 |

| 2017 | $1,181 | $49,671 | $11,037 | $38,634 |

| 2016 | $1,163 | $48,698 | $10,821 | $37,877 |

| 2015 | $1,168 | $47,968 | $10,659 | $37,309 |

| 2014 | $1,185 | $47,030 | $10,451 | $36,579 |

Source: Public Records

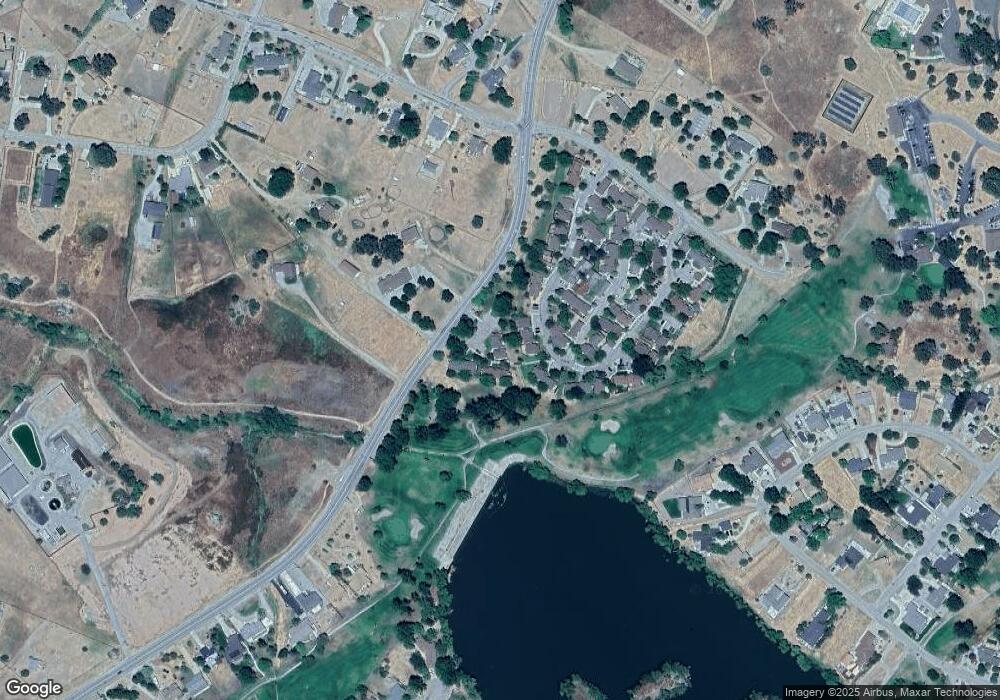

Map

Nearby Homes

- 2 Village Ln

- 1 Cloverleaf Ct

- 36 Meadow Lakes Dr

- 22 Village Ln

- 29960 Greenwater Dr

- 23911 Coral Springs Ln

- 24401 Oaktree Ct

- 23900 Wible Ct

- 24450 Oaktree Ct

- 30601 Rollingoak Dr

- 30620 Rollingoak Dr

- 23871 Pebble Beach Ln

- 29840 Pinedale Dr

- 23801 Parke Ct

- 23901 Parke Ct

- 30000 Jamaica Dunes Dr

- 29681 Greenwater Dr

- 30261 Knight Ct

- 29501 Greenwater Dr

- 30150 Jamaica Dunes Dr

- 21 Meadow Lakes Dr

- 105 Meadow Lakes Dr Unit 115

- 105 Meadow Lakes Dr Unit 115C

- 89 Meadow Lakes Dr

- 49 Meadow Lakes Dr

- 5 Cloverleaf Court 9985268

- 32 Meadow Lakes Drive 9986014

- 41 Village Ln

- 7 Cloverleaf Ct Unit 9

- 93 Meadow Lakes Dr

- 77 Meadow Lakes Dr

- 2 Meadow Lakes Dr

- 17 Cloverleaf Ct

- 117 Meadow Lakes Dr

- 40 Meadow Lakes Dr

- 33 Village Ln

- 13 Cloverleaf Ct

- 45 Meadow Lakes Dr

- 53 Meadow Lakes Dr

- 97 Meadow Lakes Dr