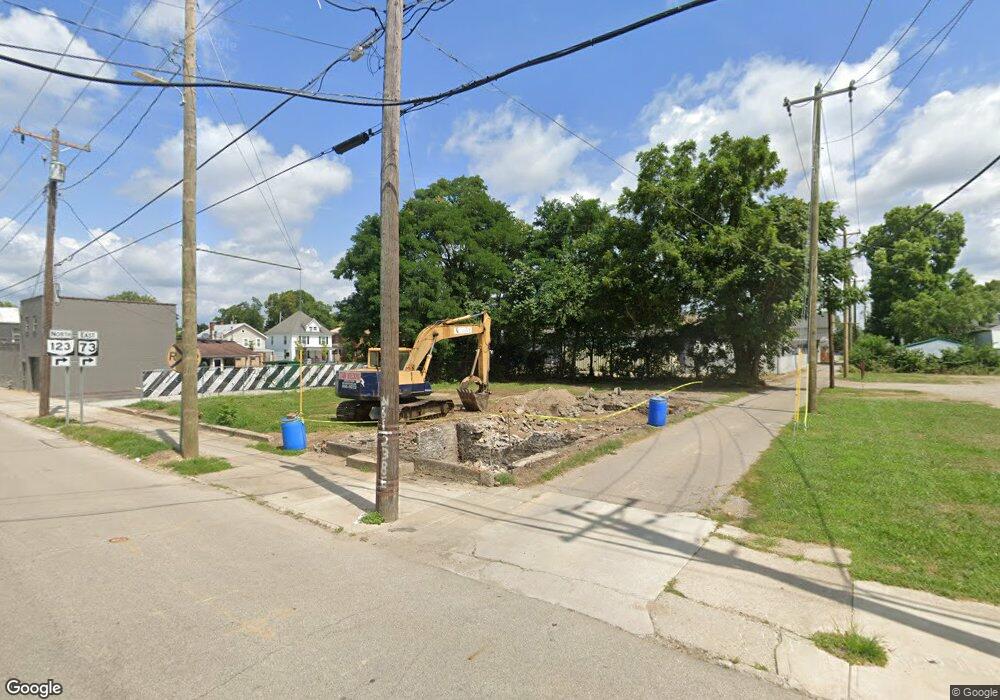

9 E 6th St Franklin, OH 45005

Estimated Value: $325,000

Studio

2

Baths

--

Sq Ft

5,227

Sq Ft Lot

About This Home

This home is located at 9 E 6th St, Franklin, OH 45005 and is currently estimated at $325,000. 9 E 6th St is a home located in Warren County with nearby schools including Franklin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 12, 2024

Sold by

Faulkner Thomas Winston

Bought by

City Of Franklin Ohio

Current Estimated Value

Purchase Details

Closed on

May 18, 2007

Sold by

Mulberry Group Inc

Bought by

Faulkner Thomas Winston

Purchase Details

Closed on

Aug 7, 2006

Sold by

Prater Dallis H and Prater Angela L

Bought by

Mulberry Group Inc

Purchase Details

Closed on

Jan 30, 2001

Sold by

Carter Judy

Bought by

Prater Dallas H and Prater Angela L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,900

Interest Rate

7.43%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 11, 2000

Sold by

Hedrick Bessie

Bought by

Carter Judy

Purchase Details

Closed on

Jul 15, 1987

Sold by

First National Bank Of Wa

Bought by

Hedric and Hedric Bessie

Purchase Details

Closed on

Apr 23, 1987

Sold by

Collier Collier and Collier James L

Bought by

First National Bank Of Wa

Purchase Details

Closed on

Nov 13, 1984

Sold by

Simmons Lanney A and Simmons Lanney A

Bought by

Collier and Collier James L

Purchase Details

Closed on

Mar 13, 1980

Sold by

Simmons Simmons and Simmons Deborah A

Purchase Details

Closed on

Dec 28, 1978

Sold by

Barlion Barlion and Barlion Ruth

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| City Of Franklin Ohio | -- | None Listed On Document | |

| Faulkner Thomas Winston | $40,900 | Fidelity Land Title | |

| Mulberry Group Inc | $40,900 | None Available | |

| Prater Dallas H | $40,900 | -- | |

| Carter Judy | $27,000 | -- | |

| Hedric | $13,000 | -- | |

| First National Bank Of Wa | $16,700 | -- | |

| Collier | $12,500 | -- | |

| -- | -- | -- | |

| -- | $8,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Prater Dallas H | $40,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $363 | $6,480 | $5,860 | $620 |

| 2024 | $363 | $6,480 | $5,860 | $620 |

| 2023 | $364 | $5,883 | $5,323 | $560 |

| 2022 | $367 | $5,884 | $5,324 | $560 |

| 2021 | $353 | $5,884 | $5,324 | $560 |

| 2020 | $386 | $5,884 | $5,324 | $560 |

| 2019 | $356 | $5,884 | $5,324 | $560 |

| 2018 | $352 | $5,884 | $5,324 | $560 |

| 2017 | $363 | $5,884 | $5,324 | $560 |

| 2016 | $374 | $5,915 | $5,915 | $0 |

| 2015 | $373 | $5,915 | $5,915 | $0 |

| 2014 | $373 | $5,920 | $5,920 | $0 |

| 2013 | $321 | $5,920 | $5,920 | $0 |

Source: Public Records

Map

Nearby Homes

- 1200 Riley Blvd

- 0 E 4th St

- 627 S River St

- 309 Oxford Rd

- 218 Roberts Ave

- 202 E 2nd St

- 205 Oxford Rd

- 210 N Riley Blvd

- 410 Park Ave

- 1117 S Main St

- 509 Forest Ave

- 511 Forest Ave

- 413 Spring Ave

- 388 Thomas Dr

- 616 Lake Ave

- 712 Abney Ln

- 551 E 2nd St

- 0 Kathy Ln Unit 1834240

- 0 Kathy Ln Unit 930066

- 605 Spring Ave

Your Personal Tour Guide

Ask me questions while you tour the home.