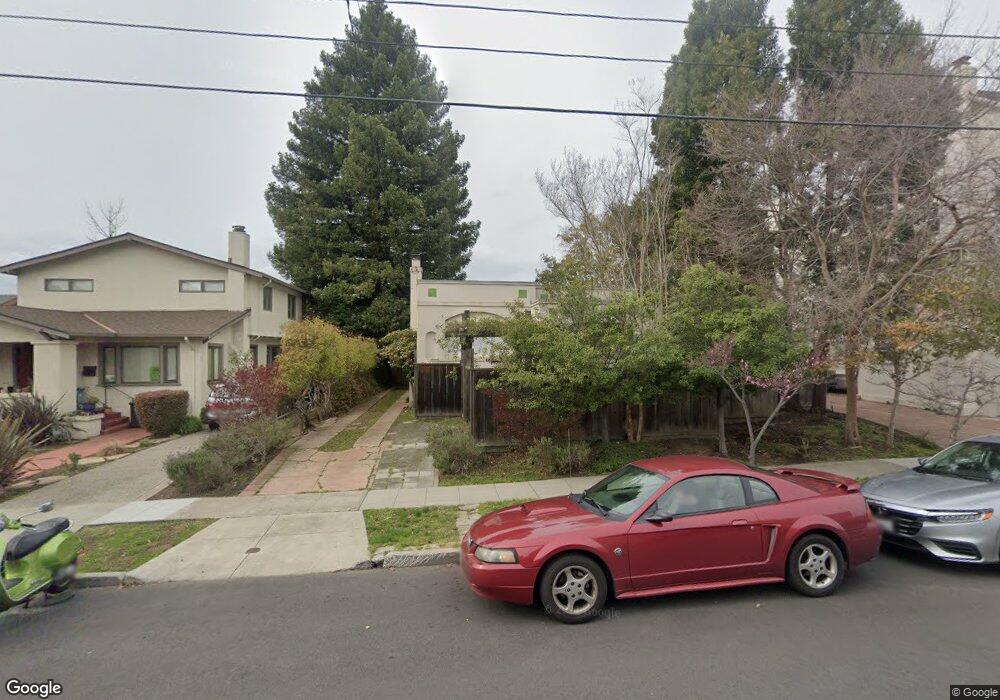

910 Modoc St Berkeley, CA 94707

Northbrae NeighborhoodEstimated Value: $1,329,137 - $1,591,000

2

Beds

1

Bath

1,329

Sq Ft

$1,104/Sq Ft

Est. Value

About This Home

This home is located at 910 Modoc St, Berkeley, CA 94707 and is currently estimated at $1,467,784, approximately $1,104 per square foot. 910 Modoc St is a home located in Alameda County with nearby schools including Thousand Oaks Elementary School, Ruth Acty Elementary, and Berkeley Arts Magnet at Whittier School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2021

Sold by

Wood Winifred Yen

Bought by

Wood Winifred Yen and Cinnamond Scott

Current Estimated Value

Purchase Details

Closed on

Jan 6, 1995

Sold by

Wood Philip D

Bought by

Wood Philip D and Wood Winifred Yen

Purchase Details

Closed on

Dec 30, 1994

Sold by

Wood Winifred Yen

Bought by

Wood Philip D

Purchase Details

Closed on

Oct 27, 1994

Sold by

Tsai Jen Yang and Yang Hsi Mei

Bought by

Wood Philip D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

6.75%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wood Winifred Yen | -- | None Listed On Document | |

| Wood Philip D | -- | -- | |

| Wood Philip D | -- | Chicago Title Company | |

| Wood Philip D | $250,000 | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wood Philip D | $200,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,575 | $419,901 | $125,970 | $293,931 |

| 2024 | $8,575 | $411,670 | $123,501 | $288,169 |

| 2023 | $9,131 | $403,600 | $121,080 | $282,520 |

| 2022 | $7,513 | $395,687 | $118,706 | $276,981 |

| 2021 | $8,030 | $387,930 | $116,379 | $271,551 |

| 2020 | $7,558 | $383,951 | $115,185 | $268,766 |

| 2019 | $7,203 | $376,424 | $112,927 | $263,497 |

| 2018 | $7,050 | $369,044 | $110,713 | $258,331 |

| 2017 | $6,786 | $361,810 | $108,543 | $253,267 |

| 2016 | $6,512 | $354,717 | $106,415 | $248,302 |

| 2015 | $6,409 | $349,390 | $104,817 | $244,573 |

| 2014 | $6,285 | $342,547 | $102,764 | $239,783 |

Source: Public Records

Map

Nearby Homes

- 1015 Merced St

- 1546 Beverly Place

- 1983 Yosemite Rd

- 1960 El Dorado Ave

- 1809 Hopkins St

- 1563 Thousand Oaks Blvd

- 1923 Yolo Ave

- 1328 Marin Ave

- 826 Indian Rock Ave

- 770 Santa Barbara Rd

- 1038 Pomona Ave

- 600 San Luis Rd

- 820 Key Route Blvd

- 938 Masonic Ave

- 1127 Key Route Blvd

- 720 Key Route Blvd

- 1360 Acton St

- 549 Santa Barbara Rd

- 371 Ocean View Ave

- 1425 Martin Luther King jr Way

Your Personal Tour Guide

Ask me questions while you tour the home.