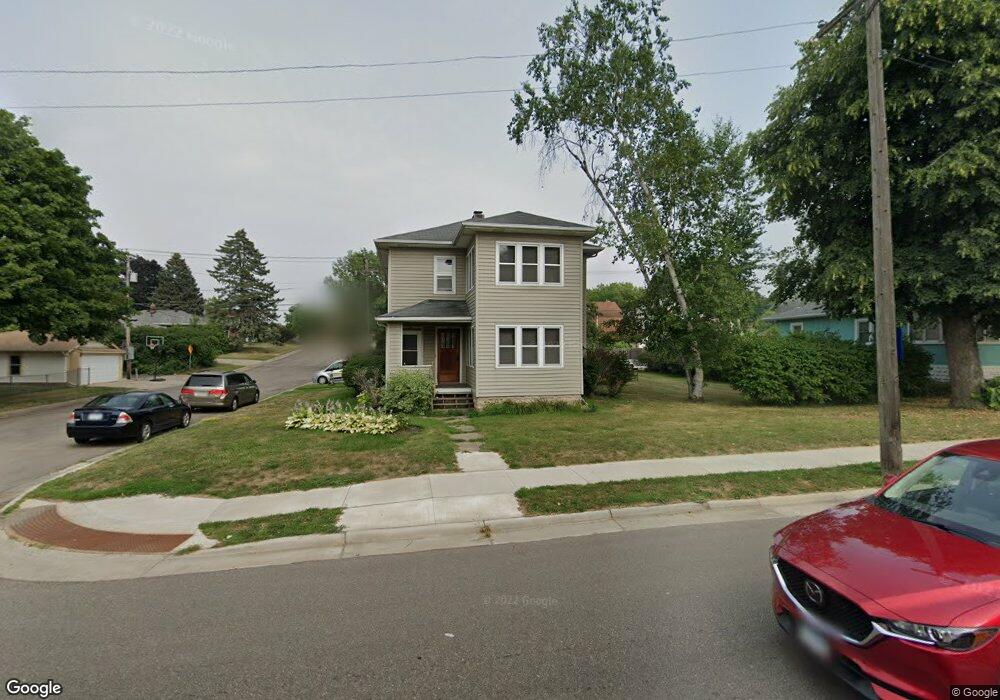

922 Smith Ave S Saint Paul, MN 55118

Estimated Value: $312,000 - $436,842

4

Beds

2

Baths

2,320

Sq Ft

$164/Sq Ft

Est. Value

About This Home

This home is located at 922 Smith Ave S, Saint Paul, MN 55118 and is currently estimated at $380,211, approximately $163 per square foot. 922 Smith Ave S is a home located in Dakota County with nearby schools including Somerset Elementary School, Heritage E-STEM Magnet School, and Two Rivers High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 13, 2017

Sold by

Johanson Todd L and Johanson Dawn

Bought by

Anderson Kari A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$178,500

Outstanding Balance

$149,098

Interest Rate

3.82%

Mortgage Type

New Conventional

Estimated Equity

$231,113

Purchase Details

Closed on

Sep 27, 2000

Sold by

Rygh Laura R

Bought by

Johanson Todd L and Turnage Tina R

Purchase Details

Closed on

Jan 29, 1999

Sold by

Emerson Marcella V

Bought by

Nedved Jonathan Peter and Tomann Christine Lynn

Purchase Details

Closed on

Jan 28, 1999

Sold by

Nedved Jonathan Peter and Tomann Christine Lynn

Bought by

Rygh Laura R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anderson Kari A | $210,000 | Home Title Inc | |

| Johanson Todd L | $145,900 | -- | |

| Nedved Jonathan Peter | $82,500 | -- | |

| Rygh Laura R | $125,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Anderson Kari A | $178,500 | |

| Closed | Nedved Jonathan Peter | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,172 | $397,100 | $62,700 | $334,400 |

| 2023 | $5,172 | $417,300 | $66,500 | $350,800 |

| 2022 | $4,336 | $364,200 | $66,200 | $298,000 |

| 2021 | $4,060 | $334,800 | $57,600 | $277,200 |

| 2020 | $3,320 | $313,200 | $54,800 | $258,400 |

| 2019 | $3,181 | $254,800 | $52,200 | $202,600 |

| 2018 | $3,636 | $234,700 | $48,800 | $185,900 |

| 2017 | $4,018 | $215,200 | $46,500 | $168,700 |

| 2016 | $3,768 | $203,600 | $42,300 | $161,300 |

| 2015 | $3,768 | $198,500 | $41,500 | $157,000 |

| 2014 | $3,552 | $180,000 | $38,500 | $141,500 |

| 2013 | $3,424 | $168,300 | $35,500 | $132,800 |

Source: Public Records

Map

Nearby Homes

- 913 Ottawa Ave

- 999 Seminole Ave

- 967 Cherokee Ave

- 822 Smith Ave S

- 801 Cherokee Ave

- 1062 Ohio St

- 1095 Cherokee Ave

- 259 Curtice St W

- 750 Delaware Ave

- 206 Winona St W

- 908 Bellows St

- 950 Bellows St

- 693 Smith Ave S

- 1000 Winston Cir

- 606 Sutcliff Cir

- 837 Bidwell St

- 663 Smith Ave S

- 1517 Timberwood Ln

- 1016 Bidwell St

- 867 Winslow Ave

- 932 Smith Ave S

- 934 Smith Ave S

- 934 Smith Ave S

- 925 Manomin Ave

- 940 Smith Ave S

- 912 912 Smith-Avenue-s

- 912 Smith Ave S

- 931 Manomin Ave

- 937 Manomin Ave

- 944 Smith Ave S

- 915 Manomin Ave

- 931 Smith Ave S

- 923 Smith Ave S

- 906 Smith Ave S

- 906 Smith Ave S

- 946 Smith Ave S

- 947 Manomin Ave

- 917 Smith Ave S

- 909 Manomin Ave

- 939 Smith Ave S