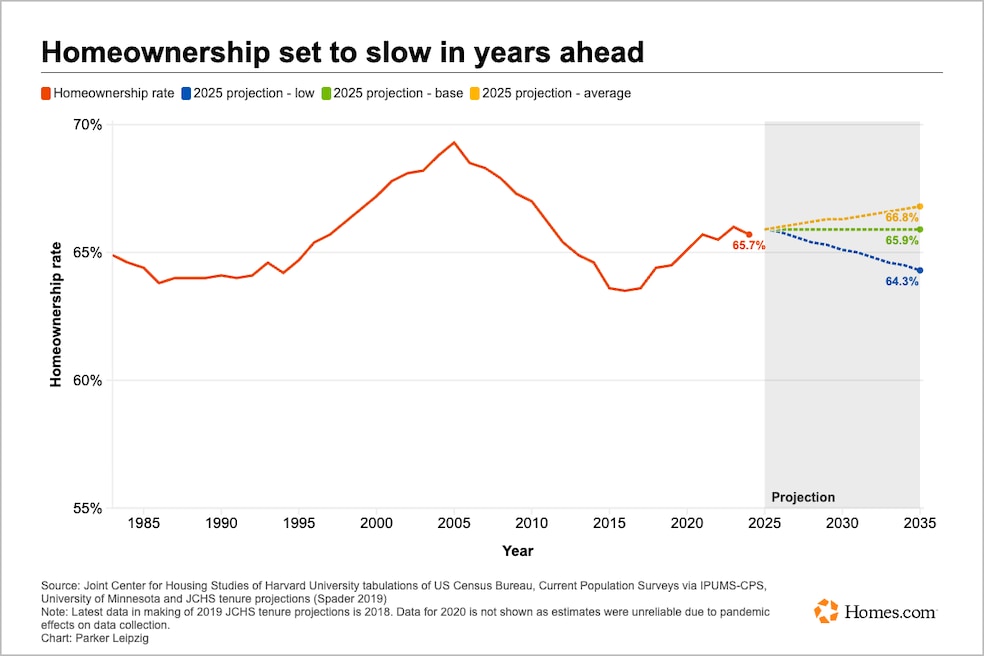

Homeownership in the U.S. may be heading for a slowdown over the next decade — especially for younger buyers — according to new projections from Harvard’s Joint Center for Housing Studies.

After a brief pandemic-era boost, U.S. homeownership rates began to falter in 2022 as rising interest rates and soaring home prices erased affordability gains, the center stated in an August paper titled "Projections of Homeownership Rates and Household Growth by Tenure for 2025-2035."

The center examined three homeownership rate scenarios:

- Baseline: rates of homeownership stay constant until 2035

- Optimistic: rates would maintain historically average growth

- Gloomy: younger buyers continue along a track for low ownership

None of these scenarios posited particularly robust growth. In fact, the center's predictions for homeownership rates suggest a cooling demand for housing:

- High: 66.8%

- Constant: 65.9%

- Low: 64.3%

When it came to the annual uptick in homeowner households, the center examined the same three scenarios and predicted that in the next 10 years, the nation could see the following increases:

- Low: 337,000 more households per year (51% below average)

- Constant: 560,000 more per year (18% below average)

- High: 685,000 more per year

Demographic shifts center on age and race

As younger buyers struggle to shoulder the expense of homeownership, baby boomer households led by individuals 75 years of age or older could "be the greatest source of growth in both owners and renters" and expand by between 5.7 and 5.8 million households by 2035, the paper stated.

Older millennials will also be active on the buying scene, but it remains to be seen whether younger buyers will follow suit or remain hamstrung by high costs.

Among its predictions for the coming decade, the paper found that people of color account for "almost all of the net gains in households ... with Hispanics alone accounting for nearly half of all household growth."

Despite its predictions, JCHS emphasized that "projecting future homeownership trends is challenging," given how deeply market forces influence who buys a home and when they do so. If today's high mortgage rates and home prices continue, the center's prediction for low ownership and cool household formation might come to pass, but it said in an announcement accompanying the paper, that forecasts should be taken "within a wide margin of error": "A sudden decline in mortgage interest rates or other impacts to affordability could support a higher scenario for homeownership rates and a drop in rental demand."