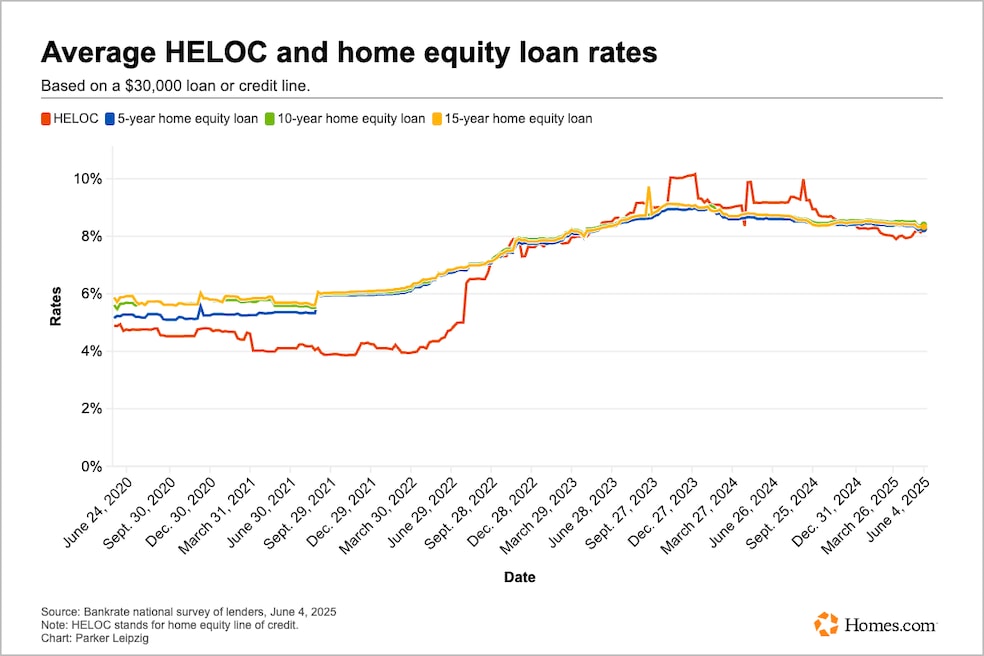

The average rate on a $30,000 home equity line of credit (HELOC) rose to 8.27%, one of the highest rates this year, according to financial services company Bankrate's most recent weekly national survey of lenders. Other types of home equity loans also grew a bit in the past week. The rate for a five-year loan, for instance, is currently 8.24%.

The Consumer Financial Protection Bureau defines a HELOC as a loan that allows you to borrow, spend and repay as you go — using your own home as collateral for the loan. A homeowner can borrow a percentage of their equity, the value of their home minus the amount owed on the mortgage.

The HELOC and home equity loan rates are higher than earlier this year, but remain lower than the current average personal loan and credit card interest rates of 12.65% and 20.12% respectively, according to Bankrate data.

Recent data from the Mortgage Monitor reports from financial data services provider Intercontinental Exchange stated the cumulative home equity level in the country hit a record high entering the second quarter of the year. Mortgages on residential properties carried a total of $17.6 trillion in equity, up 4% from last year, the report said. Equity tends to rise with the increase in home prices, which has been a continuing trend.

The firm also said that if the Federal Reserve follows through with the proposed rate cuts of 3%, HELOC rates could drop to the mid-6% range by early 2026, making this option more attractive to homeowners.