People spent a lot of time in their homes during the pandemic, leading homeowners to spend more on improvements, whether required, for routine maintenance or simply to boost their property values.

That spending is easing, but only somewhat.

"Since peaking at $611 billion in 2022, the remodeling market has contracted slightly in the face of mixed economic and industrial conditions," according to the "2025 Improving America's Housing" report that the Joint Center for Housing Studies of Harvard University released in March. Those conditions include labor shortages and "significant inflation" in the cost of building materials.

Despite those volatile economic conditions, the center projects spending on remodeling to remain "far above pre-pandemic levels": "This extraordinary boom was driven by strong growth in the number of owners undertaking projects and in average spending, bolstered by a healthy [overall] labor market, record-high property values, and aging homes in need of investment," the report indicated. "Many owners continue to adapt their properties for changing needs and uses, even as today’s lower rates of personal savings and household mobility dampen improvement and repair spending."

Home improvement spending varies wildly by age

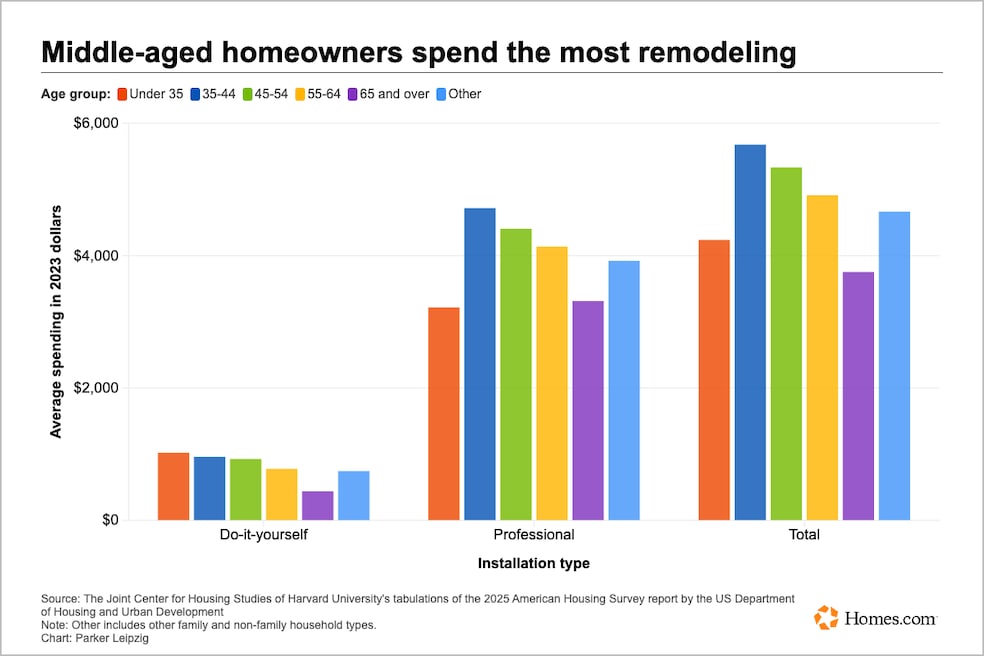

Middle-aged homeowners spent the most on remodeling in 2023, the center reported. In 2023, per-owner spending by households aged 35 to 64 was 37 percent greater than the averages for the youngest and oldest households.

Sophia Wedeen, senior research analyst at the center, said homeowners typically spend the most on improvements during this time because both their family and income sizes are growing.

Younger homeowners, identified as those under 35, pursue more DIY projects. In fact, they had the highest average DIY expenditure at $1,000 per owner.

There is also a disparity in the amount that different racial and ethnic groups can afford to invest in improvements.

White homeowners still spent the most on remodeling projects.

"These disparities reflect centuries of discriminatory policies and practices that have produced enduring inequities in income, homeownership rates, home values, and home equity — all major drivers of remodeling activity," Wedeen wrote in the report.

The tariff showdown has already resulted in higher building material costs and may factor into how much homeowners spend on improvement projects going forward.