Foreclosures on property across the U.S. rose year over year in both starts and completions in August, according to data analytics firm ATTOM.

The 35,697 properties facing foreclosure filings represented a 1% drop from the previous month but an 18% increase from August 2024. This marked the sixth consecutive month of increases over the previous year.

“While overall levels remain below those seen before the pandemic, the ongoing rise in both foreclosure starts and completions suggests that some homeowners may be experiencing added financial strain in the current high-cost and high-interest-rate environment,” Rob Barber, the CEO of ATTOM Data, said.

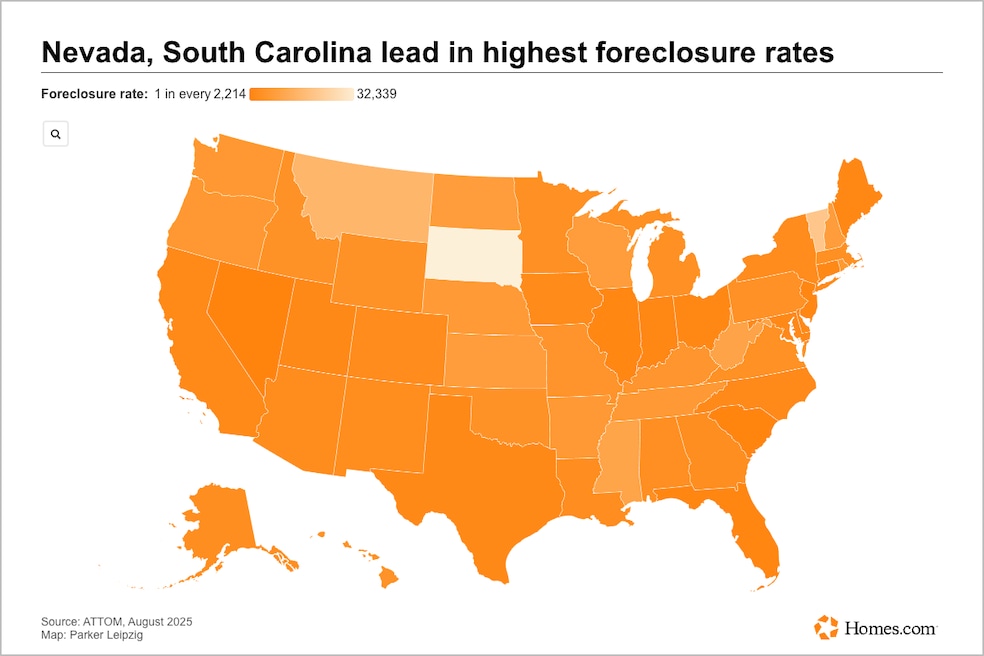

Foreclosures in the U.S. averaged one in every 3,987 homes nationwide. Nevada led the country with a foreclosure for one in every 2,069 homes, followed by South Carolina with one in every 2,152 and Florida with one foreclosure for every 2,512 homes.

According to ATTOM, South Dakota had the lowest foreclosure rate, with one foreclosure in every 33,242 homes. Vermont had the next lowest, with one in every 21,067.

Lakeland, Florida, had the highest rate among major metropolitan areas, with one in 1,212 homes with a filing. Lakeland had been named one of the fastest-growing cities in the country by the U.S. Census Bureau as recently as last year.