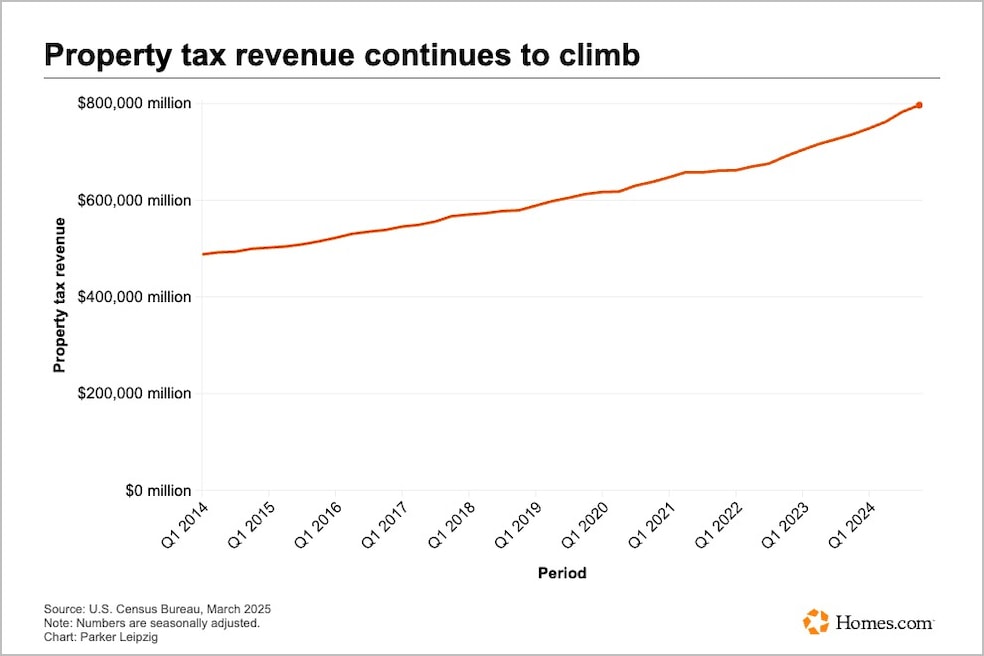

Rising property tax collections helped boost state and local tax revenue totals from 2023 to 2024, according to new census data.

Property tax revenue totaled $787 billion in 2024, up 8.2% from the year before. Property taxes accounted for 38% of all state and local revenue nationally.

General sales tax revenue increased 1.2% compared to the year prior, and individual income tax rose 4.7%. Corporate income tax inched up slightly by 0.2%.

"The sharp year-over-year rise in property tax collections was driven primarily by the rapid home price inflation seen over 2023 and 2024," economists from the National Association of Home Builders said in an analysis of the data.

The trend is likely to continue given that house prices are projected to rise 3% this year, according to J.P. Morgan Research.

In the home builder association's analysis, the economists cited Vermont as the state whose government tax revenue was most heavily reliant on property tax — 27.7% of the state's tax revenue came from property tax. Additionally, 17 states did not collect property taxes.

Following Vermont as the state with whose property taxes made up the highest share of its tax revenue in 2024, Wyoming, Washington and Arkansas were the states with the next highest share of property taxes of total state tax revenue.