New tariffs kick in

The latest tariffs imposed on imports went into effect Thursday.

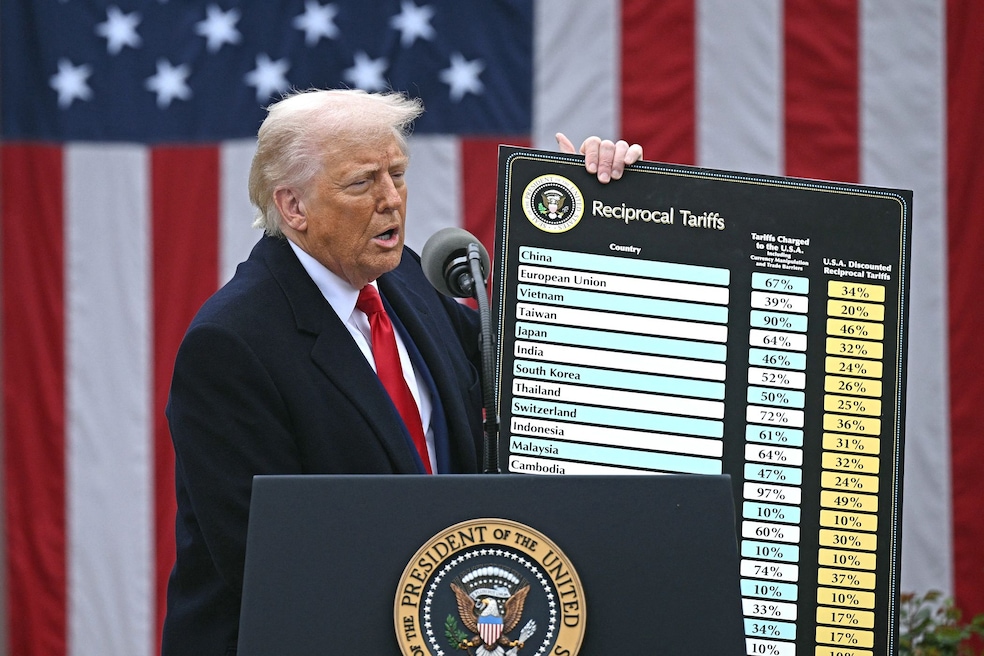

President Donald Trump’s so-called reciprocal tariffs are a means to put pressure on countries deemed to be engaging in activity that threatens the security or economy of the United States.

More than 60 countries face reciprocal tariffs ranging from 10% to 50%. India and Brazil face the highest rates.

Trump has homed in on India’s purchase of oil from Russia, while he blames the governmental actions of Brazil for its high level of tariffs. Trump specified Brazil’s government as interfering with the U.S. economy, infringing on U.S. citizens’ rights, and persecuting former President Jair Bolsonaro, who is on trial for allegedly starting a coup to remain in office.

Concerns about the increased cost of construction arose during Trump’s first round of tariffs imposed earlier this year on Canada and Mexico, two countries that export significant amounts of building materials into the United States. Both countries avoided additional tariffs this week. Canada is sanctioned with a 35% tax on imports while Mexico has a 25% tariff on its goods.

Consumers expect more inflation

The latest survey of consumer expectations shows a twinge of relief for consumers.

The Federal Reserve Bank of New York's Center for Microeconomic Data survey tracks consumer perceptions and expectations of inflation, costs for food, gas, housing, and education, employment and earnings.

The latest finding released Thursday noted inflation expectations in July increased slightly both in the one and five-year predictions. At the same time, uncertainty on the future of inflation declined.

Fewer people believe the unemployment rate will increase in one year, and more consumers feel confident about finding a new job if they were to lose their current one.

Looking at the government, the survey hit its highest share of consumers (9.1%) anticipating an increase in government debt by year-end.

Unemployment rises

New unemployment filings for last week pushed unemployment to the highest level since the week ended July 5. Last week saw an uptick of 7,000 claims to 226,000.

The data comes a week after the Bureau of Labor Statistics said job creation was low in July, and even lower than anticipated in May and June. Employment is a strong indicator of economic health, and the jobs report helped bring the stock market down from recent highs. President Trump soon after moved to fire BLS Commissioner Erika McEntarfer for what he said were "rigged" numbers.

The increase in unemployment was relatively stable, noted economists, as the number of filings has stayed below 10,000 for nearly three years.