Home flipping profits are down this year, but some hotspots remain in the United States.

Although the profit margin made on home flipping — buying, upgrading and attempting to resell a property for a profit — hit a 17-year low of 25.1% in the second quarter of 2025, the practice comprised roughly 10% of all home sales in nearly 17% of the markets ATTOM, an Irvine, California-based data analytics company analyzed.

The dip was a reversal from 2024, when flippers found a slight rise in profits. The typical profit per flip grew from $67,846 in 2023 to $72,000 in 2024. "The typical home flipped in the second quarter of 2025 was purchased by an investor for $259,700 and sold for $325,000, netting a 25.1% return on investment before expenses and a $65,300 gross profit," ATTOM reported.

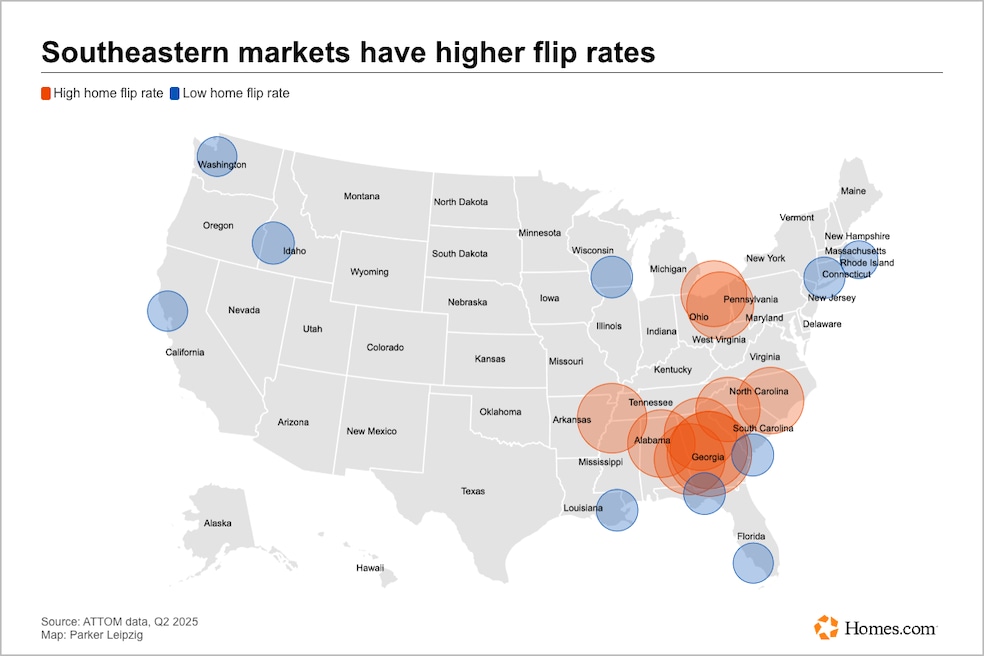

Last quarter’s flipping hotspots were concentrated in Georgia, ATTOM found. The state held four of the five regions where residential flips made up the biggest slice of home sales and 13 of the 20 counties with the highest flipping rate. Warner Robins, Georgia, led the pack, with flips accounting for 18.5% of all second-quarter home sales; Macon had 15.5%; Atlanta followed with 13.6%; and Columbus saw 13%.

Tennessee rounded out the top five, with Memphis reporting flip shares of 12.5%.

Some of the country’s priciest housing markets had the lowest flipping rates last quarter:

- Seattle (4.1%)

- New Orleans (4.5%)

- Boston (4.8%)

- Portland, Oregon (5%)

- Honolulu (5%)

Overall, flipping profit margins tanked last quarter across the country, ATTOM found. In 70% of the 183 markets it analyzed, profit margins were down year over year, plummeting in regions including Fort Smith, Arkansas, and Green Bay, Wisconsin. A mere 26.2% of markets observed boasted profit margins at or exceeding 50%, and despite being a relatively popular area for flipping, no Georgia markets had notably large profit margins last quarter. The regions with the largest typical profit margins last quarter were:

- Pittsburgh (106.8%)

- Shreveport, Louisiana (104.2%)

- Scranton, Pennsylvania (104.1%)

- Kalamazoo, Michigan (100%)

- Buffalo, New York (91.7%)

Alternatively, areas that saw the smallest profit margins last quarter were:

- Austin, Texas (5.5%)

- San Antonio (7.7%)

- Dallas (9.3%)

- Raleigh, North Carolina (10.3%)

- Salt Lake City (10.8%)