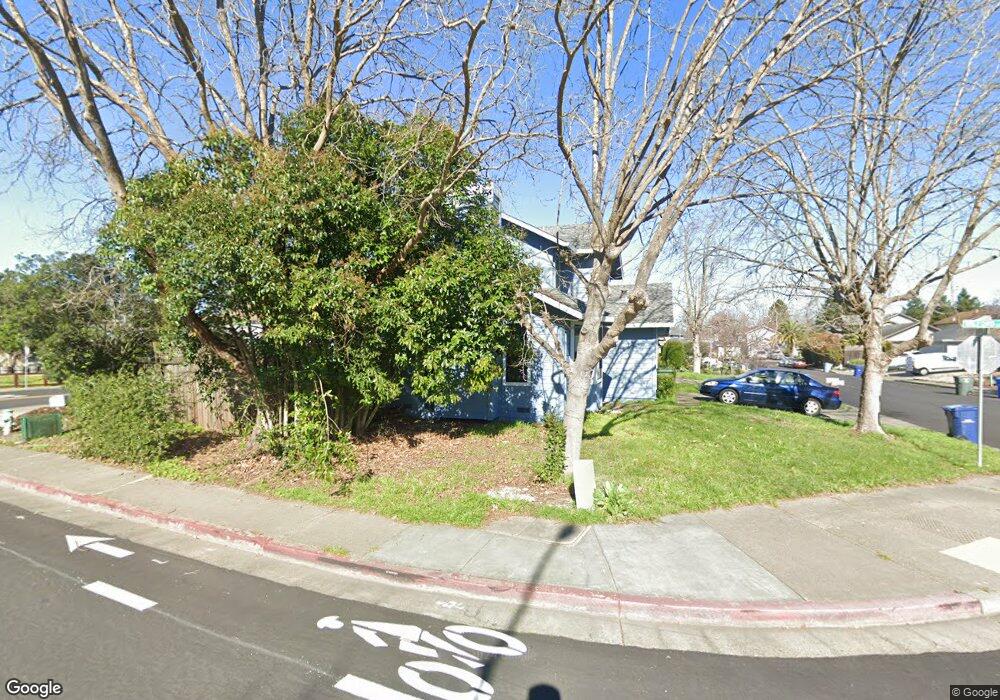

10 Gilbert Way Cotati, CA 94931

Estimated Value: $720,000 - $830,000

3

Beds

2

Baths

1,377

Sq Ft

$545/Sq Ft

Est. Value

About This Home

This home is located at 10 Gilbert Way, Cotati, CA 94931 and is currently estimated at $749,953, approximately $544 per square foot. 10 Gilbert Way is a home located in Sonoma County with nearby schools including Rancho Cotate High School, Cross & Crown Lutheran School, and Bridghaven.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 18, 2005

Sold by

Richardson Denis and Richardson Michelle S

Bought by

Ortiz Ninfa E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$104,482

Interest Rate

5.87%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$645,471

Purchase Details

Closed on

Nov 15, 2000

Sold by

Lasley Jerry H and Lasley Beverley Y

Bought by

Richardson Denis E and Richardson Michelle S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$271,200

Interest Rate

7.82%

Purchase Details

Closed on

Nov 14, 2000

Sold by

Lasley Chris H

Bought by

Lasley Chris H and Sommer Lasley Annie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$271,200

Interest Rate

7.82%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ortiz Ninfa E | $530,000 | Fidelity National Title Co | |

| Richardson Denis E | $339,000 | Old Republic Title Company | |

| Lasley Chris H | -- | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ortiz Ninfa E | $200,000 | |

| Previous Owner | Richardson Denis E | $271,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,588 | $738,759 | $295,503 | $443,256 |

| 2024 | $8,588 | $724,274 | $289,709 | $434,565 |

| 2023 | $8,588 | $710,074 | $284,029 | $426,045 |

| 2022 | $8,404 | $696,152 | $278,460 | $417,692 |

| 2021 | $7,293 | $532,000 | $213,000 | $319,000 |

| 2020 | $6,716 | $532,000 | $213,000 | $319,000 |

| 2019 | $6,755 | $532,000 | $213,000 | $319,000 |

| 2018 | $6,495 | $532,000 | $213,000 | $319,000 |

| 2017 | $6,147 | $502,000 | $201,000 | $301,000 |

| 2016 | $5,063 | $422,000 | $169,000 | $253,000 |

| 2015 | $4,649 | $391,000 | $156,000 | $235,000 |

| 2014 | $4,172 | $346,000 | $138,000 | $208,000 |

Source: Public Records

Map

Nearby Homes

- 79 William St Unit B

- 7517 Bobbie Way

- 8175 Arthur St

- 359 Bonnie Ave

- 218 W Cotati Ave

- 377 Maple Ave

- 293 Lincoln Ave

- 220 Arlen Dr

- 950 Santa Alicia Dr

- 7080 Gravenstein Hwy

- 431 Lincoln Ave

- 23 Pine Tree Cir

- 7459 Alder Ave

- 8020 Beverly Dr

- 750 W School St

- 21 Avram Ave

- 11 Avram Ave

- 839 Bernadette Ave

- 761 Brett Ave

- 7257 Belita Ave

- 14 Gilbert Way

- 18 Gilbert Way

- 404 Wilford Ln

- 22 Gilbert Way

- 305 Wilford Ln

- 15 Gilbert Way

- 214 Wilford Ln

- 19 Gilbert Way

- 8705 Gravenstein Way

- 26 Gilbert Way

- 408 Wilford Ln

- 223 Wilford Ln

- 223 Wilford Ln

- 401 Wilford Ln

- 8709 Gravenstein Way

- 2 Gilbert Ct

- 23 Gilbert Way

- 8713 Gravenstein Way

- 30 Gilbert Way