102 Windward Common Unit 2103 Livermore, CA 94551

Las Positas NeighborhoodEstimated Value: $754,000 - $819,000

3

Beds

3

Baths

1,322

Sq Ft

$601/Sq Ft

Est. Value

About This Home

This home is located at 102 Windward Common Unit 2103, Livermore, CA 94551 and is currently estimated at $794,531, approximately $601 per square foot. 102 Windward Common Unit 2103 is a home located in Alameda County with nearby schools including Rancho Las Positas Elementary School, Junction Avenue K-8 School, and Granada High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 27, 2023

Sold by

Oates Clifford

Bought by

Lyle Brendan Robert

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Outstanding Balance

$486,694

Interest Rate

6.63%

Mortgage Type

New Conventional

Estimated Equity

$307,837

Purchase Details

Closed on

Aug 12, 2003

Sold by

Couch Richard G and Couch Julie Norris

Bought by

Oates Clifford

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,600

Interest Rate

6.12%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 25, 2000

Sold by

Ryland Homes Of California Inc

Bought by

Couch Richard G and Couch Julie Norris

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lyle Brendan Robert | $853,000 | Chicago Title | |

| Oates Clifford | $372,000 | -- | |

| Couch Richard G | $305,500 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lyle Brendan Robert | $500,000 | |

| Previous Owner | Oates Clifford | $297,600 | |

| Closed | Oates Clifford | $74,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,589 | $863,060 | $261,018 | $609,042 |

| 2024 | $10,589 | $846,000 | $255,900 | $597,100 |

| 2023 | $6,690 | $501,341 | $152,502 | $355,839 |

| 2022 | $6,591 | $491,375 | $149,512 | $348,863 |

| 2021 | $5,849 | $481,606 | $146,582 | $342,024 |

| 2020 | $6,247 | $483,600 | $145,080 | $338,520 |

| 2019 | $6,249 | $474,117 | $142,235 | $331,882 |

| 2018 | $6,117 | $464,821 | $139,446 | $325,375 |

| 2017 | $5,962 | $455,707 | $136,712 | $318,995 |

| 2016 | $5,665 | $446,771 | $134,031 | $312,740 |

| 2015 | $5,339 | $440,060 | $132,018 | $308,042 |

| 2014 | $4,802 | $390,000 | $117,000 | $273,000 |

Source: Public Records

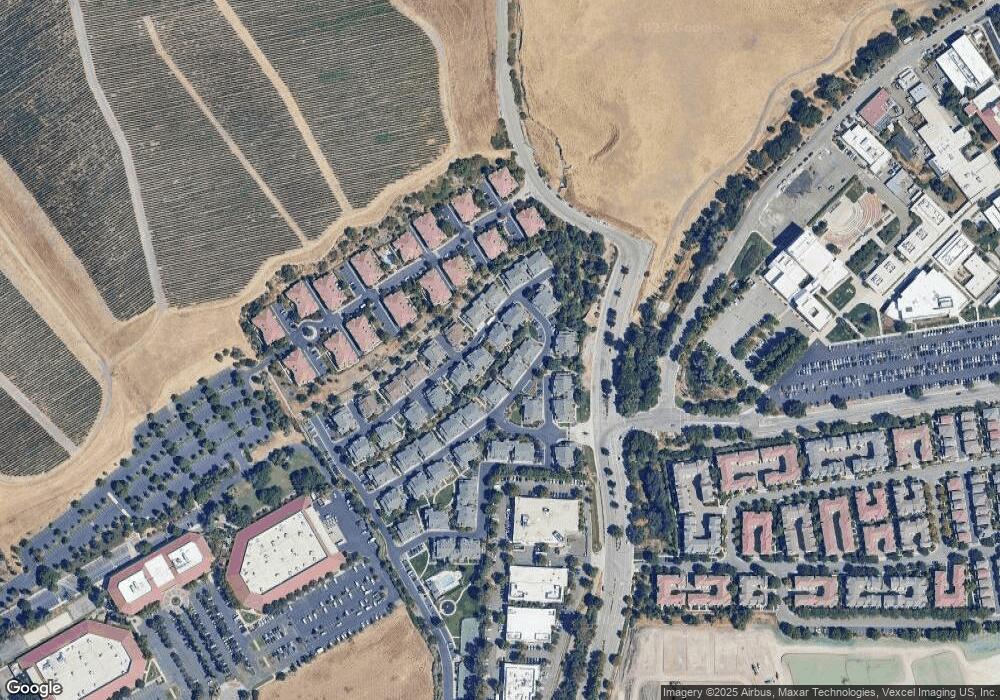

Map

Nearby Homes

- 51 Bellington Common Unit 8

- 2833 Alnwick Ave Unit 7

- 196 Heligan Ln Unit 4

- Residence 2 Plan at Amarone - Row Townhomes

- Residence 1 Plan at Amarone - Row Townhomes

- 2815 Triad Place

- 105 Brutus Commons

- 299 Hermes Commons

- 311 Hermes Commons

- Residence 3 Plan at Cava - Row Townhomes

- Residence 5 Plan at Cava - Row Townhomes

- 2906 Triad Dr

- Residence 2 Plan at Cava - Row Townhomes

- Residence 1 Plan at Cava - Stacked Flats

- Residence 4 Plan at Cava - Row Townhomes

- Residence 1 Plan at Cava - Back-to-Back Townhomes

- Residence 2 Plan at Cava - Stacked Flats

- Residence 1 Plan at Cava - Row Townhomes

- Residence 2 Plan at Cava - Back-to-Back Townhomes

- Residence 3 Plan at Cava - Stacked Flats

- 102 Windward Common Unit 3

- 102 Windward Common Unit 7

- 102 Windward Common Unit 4

- 102 Windward Common

- 102 Windward Common Unit 2

- 102 Windward Common Unit 5

- 102 Windward Common Unit 1

- 102 Windward Common Unit 2108

- 102 Windward Common Unit 2104

- 102 Windward Common Unit 2101

- 102 Windward Common Unit 2107

- 102 Windward Common Unit 2105

- 102 Windward Common Unit 2102

- 102 Windward Common Unit 2106

- 139 Windward Common

- 139 Windward Common Unit 5

- 139 Windward Common Unit 7

- 139 Windward Common Unit 2

- 139 Windward Common Unit 8

- 139 Windward Common Unit 1