10665 Hearst Willits Rd Willits, CA 95490

Estimated Value: $506,000 - $754,118

Studio

--

Bath

11,877

Sq Ft

$51/Sq Ft

Est. Value

About This Home

This home is located at 10665 Hearst Willits Rd, Willits, CA 95490 and is currently estimated at $600,030, approximately $50 per square foot. 10665 Hearst Willits Rd is a home located in Mendocino County with nearby schools including Brookside Elementary School, Blosser Lane Elementary School, and Baechtel Grove Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2023

Sold by

Hagerty Scott

Bought by

Liang Senhan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,000

Outstanding Balance

$295,221

Interest Rate

6.39%

Mortgage Type

New Conventional

Estimated Equity

$304,809

Purchase Details

Closed on

Mar 22, 2016

Sold by

Dangers Dickson

Bought by

Hagerty Scott

Purchase Details

Closed on

Jan 7, 2005

Sold by

Peters Clarence P and Peters Natalie L

Bought by

Dangers Dickson

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,000

Interest Rate

5.69%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Liang Senhan | $760,000 | Old Republic Title | |

| Hagerty Scott | $250,000 | None Available | |

| Dangers Dickson | $550,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Liang Senhan | $304,000 | |

| Previous Owner | Dangers Dickson | $325,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,235 | $783,629 | $416,160 | $367,469 |

| 2023 | $9,235 | $790,460 | $256,008 | $534,452 |

| 2022 | $9,451 | $829,962 | $250,989 | $578,973 |

| 2021 | $8,380 | $726,684 | $246,068 | $480,616 |

| 2020 | $7,582 | $609,798 | $243,545 | $366,253 |

| 2019 | $4,529 | $371,420 | $238,770 | $132,650 |

| 2018 | $4,069 | $364,140 | $234,090 | $130,050 |

| 2017 | $3,982 | $357,000 | $229,500 | $127,500 |

| 2016 | $7,161 | $647,609 | $485,118 | $162,491 |

| 2015 | $7,037 | $637,884 | $477,833 | $160,051 |

| 2014 | $6,947 | $625,394 | $468,477 | $156,917 |

Source: Public Records

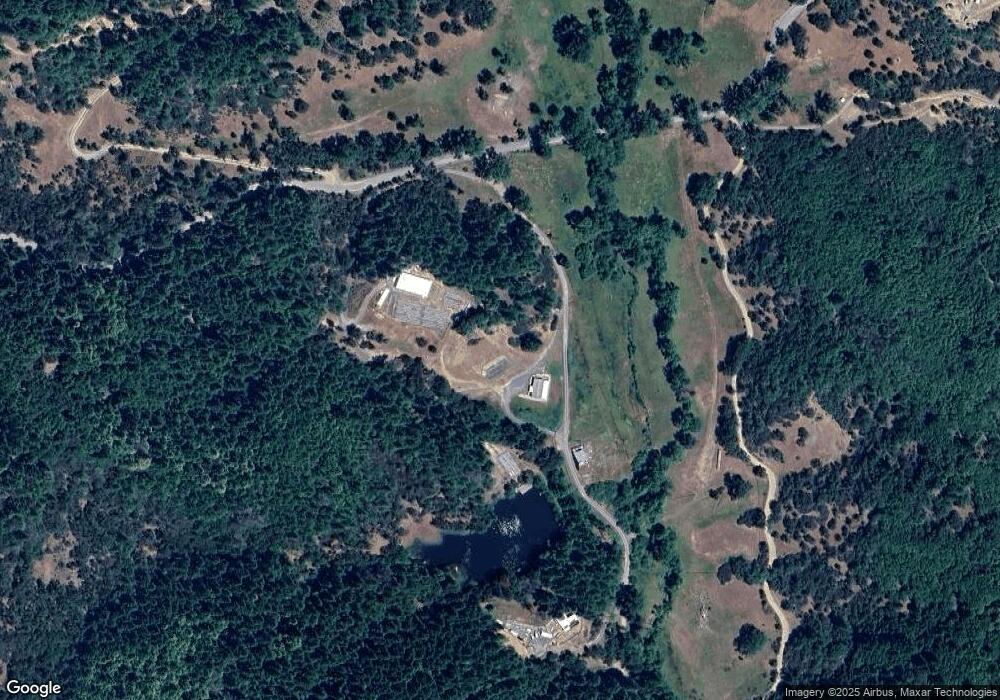

Map

Nearby Homes

- 20401 Tomki Rd

- 7020 Hearst Rd

- 6651 Hearst Willits Rd

- 18574 Tomki Rd

- 24600 String Creek Rd

- 18040 Tomki Rd

- 8400 Cave Creek Rd

- 8600 Cave Creek Rd

- 18225 Scenic Dr

- 8555 Cave Creek Rd

- 8800 Cave Creek Rd

- 19155 Scenic Dr

- 5751 Ridgewood Rd

- 25996 String Creek Rd

- 2025 Valley Rd

- 20201 Manzanita Dr

- 4101 Chinquapin Dr

- 21165 Tomki Rd

- 3651 Ridgewood Rd

- 2580 Center Valley Rd

- 10665 Hearst Willits Rd

- 10667 Hearst Willits Rd

- 10667 Hearst Rd

- 10675 Hearst Rd

- 10675 Hearst Rd

- 10673 Hearst Rd

- 10673 Hearst Willits Rd

- 10251 Hearst Willits Rd

- 10683 Hearst Rd

- 10685 Hearst Willits Rd

- 10671 Hearst Willits Rd

- 22341 Tomki Rd

- 22400 Tomki Rd

- 10700 Hearst Willits Rd

- 9200 Hearst Willits Rd

Your Personal Tour Guide

Ask me questions while you tour the home.