1437 E Marshall Ave Unit SHARP! Phoenix, AZ 85014

Camelback East Village NeighborhoodEstimated Value: $713,000 - $768,000

3

Beds

3

Baths

1,961

Sq Ft

$377/Sq Ft

Est. Value

About This Home

This home is located at 1437 E Marshall Ave Unit SHARP!, Phoenix, AZ 85014 and is currently estimated at $739,383, approximately $377 per square foot. 1437 E Marshall Ave Unit SHARP! is a home located in Maricopa County with nearby schools including Madison Rose Lane Elementary School, Madison No. 1 Middle School, and Phoenix Coding Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2024

Sold by

Kalina Kathleen Courtney

Bought by

Kathleen Courtney Kalina Trust and Kalina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$403,000

Outstanding Balance

$398,965

Interest Rate

6.09%

Mortgage Type

New Conventional

Estimated Equity

$340,418

Purchase Details

Closed on

Nov 1, 2024

Sold by

Miyatovich Lance G and West Amy K

Bought by

Kalina Kathleen Courtney

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$403,000

Outstanding Balance

$398,965

Interest Rate

6.09%

Mortgage Type

New Conventional

Estimated Equity

$340,418

Purchase Details

Closed on

Jun 20, 2023

Sold by

Peterson Living Trust

Bought by

Miyatovich Lance G and West Amy K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$580,000

Interest Rate

6.39%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 28, 2016

Sold by

Hust Brent and Hust Joe Anne D

Bought by

Peterson Donald J and Peterson Joan K

Purchase Details

Closed on

Feb 10, 2010

Sold by

Ambler John S and Ambler Elizabeth K

Bought by

Hust Brent and Hust Joe Anne D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$320,000

Interest Rate

5.03%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 2, 2005

Sold by

Prins Lee A and Prins Victoria

Bought by

Ambler John S and Ambler Elizabeth K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 14, 2002

Sold by

Stedron Michael E and Stedron Deborah L

Bought by

Prins Lee A and Prins Victoria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,000

Interest Rate

6.84%

Purchase Details

Closed on

Feb 23, 2000

Sold by

Peterson Donald J and Peterson Joan K

Bought by

Stedron Michael E and Stedron Deborah L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$209,600

Interest Rate

8.24%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 30, 1998

Sold by

Peterson Joan K

Bought by

Peterson Donald J and Peterson Joan K

Purchase Details

Closed on

May 14, 1998

Sold by

Peterson Donald James

Bought by

Peterson Joan K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kathleen Courtney Kalina Trust | -- | None Listed On Document | |

| Kalina Kathleen Courtney | $775,000 | Wfg National Title Insurance C | |

| Miyatovich Lance G | $725,000 | Pioneer Title Services | |

| Peterson Donald J | $450,000 | Wfg National Title Ins Co | |

| Hust Brent | $400,000 | Equity Title Agency Inc | |

| Ambler John S | $485,000 | Title Partners Of Phoenix Ll | |

| Prins Lee A | -- | -- | |

| Stedron Michael E | $262,000 | -- | |

| Peterson Donald J | -- | -- | |

| Peterson Joan K | -- | First American Title | |

| Peterson Joan K | $235,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kalina Kathleen Courtney | $403,000 | |

| Previous Owner | Miyatovich Lance G | $580,000 | |

| Previous Owner | Hust Brent | $320,000 | |

| Previous Owner | Ambler John S | $260,000 | |

| Previous Owner | Prins Lee A | $212,000 | |

| Previous Owner | Stedron Michael E | $209,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,382 | $45,919 | -- | -- |

| 2024 | $4,951 | $43,733 | -- | -- |

| 2023 | $4,951 | $47,870 | $9,570 | $38,300 |

| 2022 | $4,785 | $40,480 | $8,090 | $32,390 |

| 2021 | $4,832 | $39,030 | $7,800 | $31,230 |

| 2020 | $4,747 | $40,560 | $8,110 | $32,450 |

| 2019 | $4,629 | $37,270 | $7,450 | $29,820 |

| 2018 | $4,501 | $36,530 | $7,300 | $29,230 |

| 2017 | $4,267 | $31,080 | $6,210 | $24,870 |

| 2016 | $4,586 | $35,780 | $7,150 | $28,630 |

| 2015 | $4,228 | $37,510 | $7,500 | $30,010 |

Source: Public Records

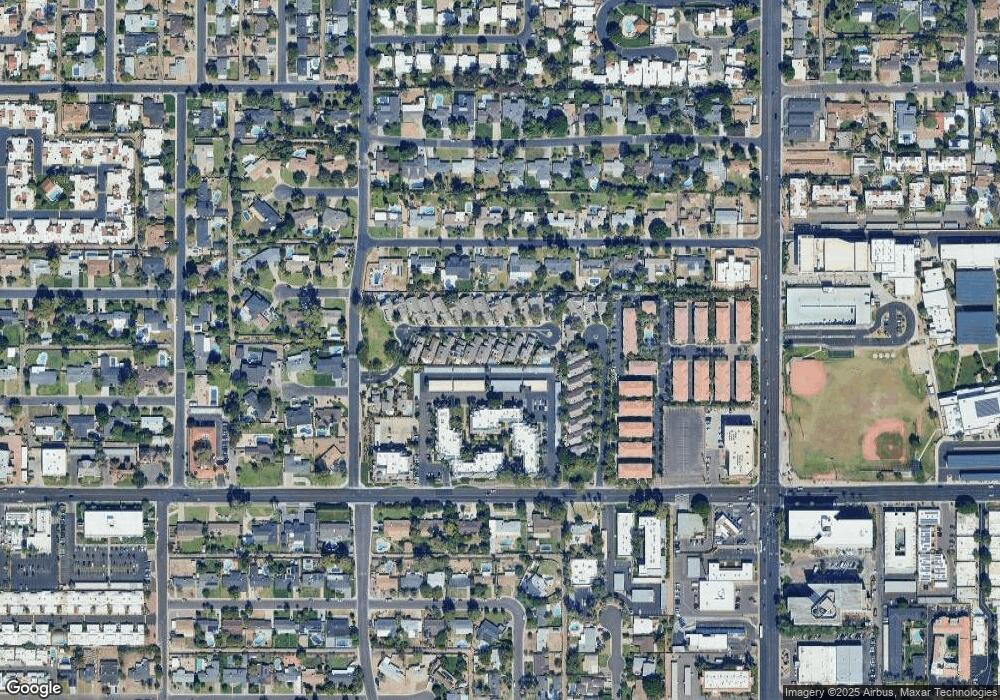

Map

Nearby Homes

- 1417 E Marshall Ave

- 1413 E San Miguel Ave

- 5550 N 16th St Unit 131

- 5319 N 15th St

- 1435 E Rancho Dr

- 1605 E Montebello Ave

- 1274 E Avenida Hermosa

- 5944 N 14th St

- 5314 N Las Casitas Place

- 1704 E Solano Dr

- 1602 E Palo Verde Dr

- 1708 E Solano Dr

- 1450 E Bethany Home Rd Unit 8

- 1450 E Bethany Home Rd Unit 31

- 1252 E Medlock Dr Unit C16

- 5640 N 12th St

- 1320 E Bethany Home Rd Unit 72

- 1320 E Bethany Home Rd Unit 86

- 1320 E Bethany Home Rd Unit 54

- 1822 E Marshall Ave

- 1437 E Marshall Ave

- 1441 E Marshall Ave

- 1433 E Marshall Ave

- 1445 E Marshall Ave

- 1429 E Marshall Ave

- 1436 E Marshall Ave

- 1425 E Marshall Ave

- 1440 E Marshall Ave

- 1432 E Marshall Ave

- 1444 E Marshall Ave

- 1449 E Marshall Ave

- 1428 E Marshall Ave

- 1515 E Marshall Ave

- 1421 E Marshall Ave

- 1448 E Marshall Ave

- 1424 E Marshall Ave

- 1452 E Marshall Ave

- 1420 E Marshall Ave

- 5542 N 15th St

- 1413 E Marshall Ave