Estimated Value: $245,819 - $305,000

2

Beds

2

Baths

1,457

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 2028 Willow Cir, Hugo, MN 55038 and is currently estimated at $268,205, approximately $184 per square foot. 2028 Willow Cir is a home located in Anoka County with nearby schools including Centerville Elementary School, Centennial Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 8, 2021

Sold by

Tvrdy Kathryn A

Bought by

Carlson David C

Current Estimated Value

Purchase Details

Closed on

Jul 28, 2017

Sold by

Watson Anthony and Watson Elizabeth

Bought by

Tvrdy Kathryn A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,102

Interest Rate

3.87%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 23, 2006

Sold by

Hofer Debra M

Bought by

Watson Anthony

Purchase Details

Closed on

Jun 30, 1997

Sold by

Park Grove Development Corp

Bought by

Hofer Debra M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carlson David C | $224,300 | Burnet Title | |

| Tvrdy Kathryn A | $162,000 | Edina Realty Title Inc | |

| Watson Anthony | $172,000 | -- | |

| Hofer Debra M | $117,670 | -- | |

| Carlson David David | $224,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Tvrdy Kathryn A | $157,102 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,020 | $244,800 | $81,400 | $163,400 |

| 2024 | $3,020 | $245,600 | $81,400 | $164,200 |

| 2023 | $2,868 | $238,300 | $69,600 | $168,700 |

| 2022 | $2,737 | $241,200 | $67,200 | $174,000 |

| 2021 | $2,689 | $191,600 | $48,900 | $142,700 |

| 2020 | $2,677 | $183,800 | $48,800 | $135,000 |

| 2019 | $2,498 | $174,100 | $40,400 | $133,700 |

| 2018 | $2,291 | $151,700 | $0 | $0 |

| 2017 | $2,004 | $144,600 | $0 | $0 |

| 2016 | $2,155 | $122,900 | $0 | $0 |

| 2015 | $1,812 | $122,900 | $27,300 | $95,600 |

| 2014 | -- | $80,200 | $18,400 | $61,800 |

Source: Public Records

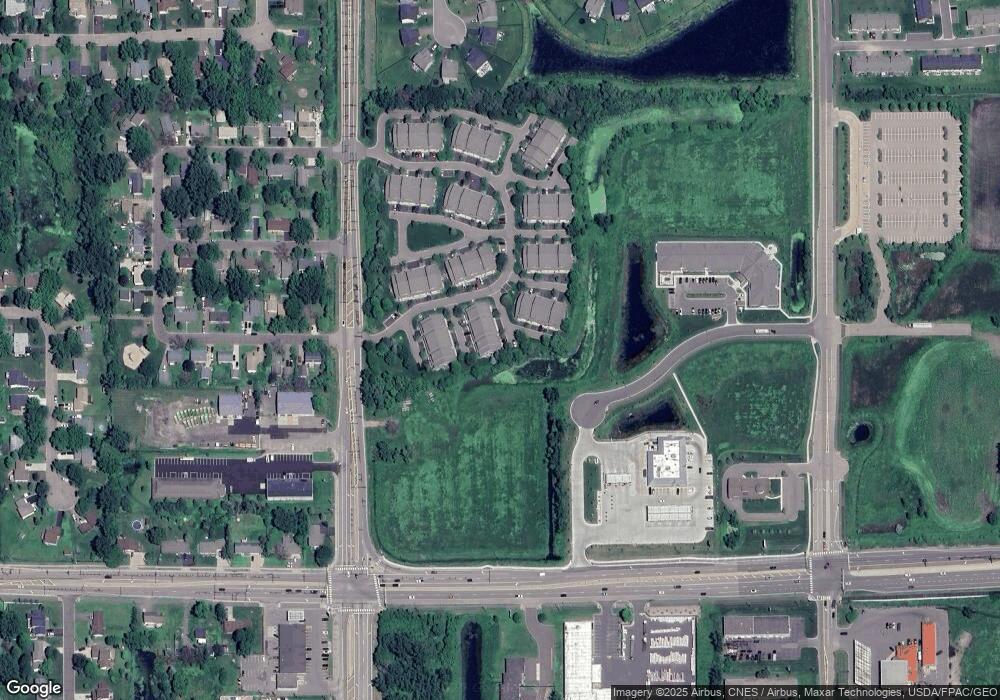

Map

Nearby Homes

- 7225 Bay Dr

- 7230 Bay Dr

- 2131 Bay Dr

- 7252 Fall Dr

- 2170 Jasper Ct

- 2170 Bay Dr

- 2150 Johanna Cir

- 1843 Pioneer Ln

- 7508 Lotus Ln

- Itasca Plan at Watermark - Landmark Collection

- Lewis Plan at Watermark - Landmark Collection

- Clearwater Plan at Watermark - Landmark Collection

- Lewis Plan at Watermark - Discovery Collection

- Donovan Plan at Watermark - Heritage Collection

- Buckingham Plan at Watermark - Lifestyle Villa Collection

- Cordoba Plan at Watermark - Lifestyle Villa Collection

- Corsica Plan at Watermark - Lifestyle Villa Collection

- Courtland II Plan at Watermark - Heritage Collection

- Courtland Plan at Watermark - Heritage Collection

- Sinclair Plan at Watermark - Landmark Collection

- 2027 Willow Cir

- 2021 Willow Cir

- 2022 Willow Cir

- 2026 Willow Cir

- 2023 Willow Cir

- 2041 Willow Cir

- 2025 Willow Cir

- 2024 Willow Cir

- 2042 Willow Cir

- 2018 Willow Cir

- 2017 Willow Cir

- 2043 Willow Cir

- 2016 Willow Cir

- 2048 Willow Cir

- 2047 Willow Cir

- 2044 Willow Cir

- 2015 Willow Cir

- 2011 Willow Cir

- 2012 Willow Cir

- 2046 Willow Cir

Your Personal Tour Guide

Ask me questions while you tour the home.