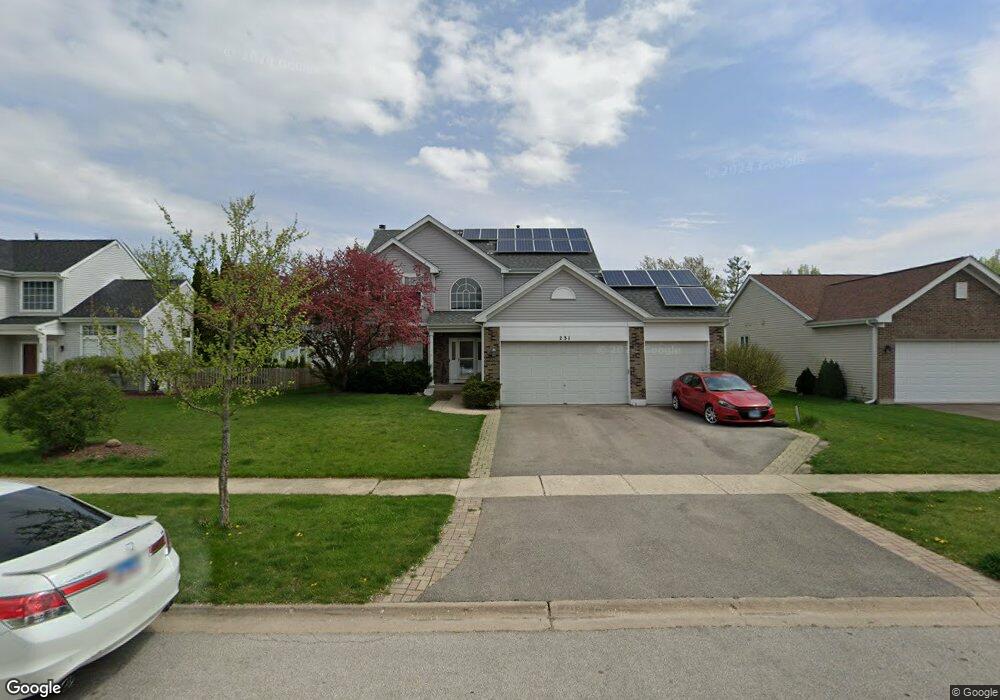

231 Angela Cir Oswego, IL 60543

North Oswego NeighborhoodEstimated Value: $429,000 - $446,000

4

Beds

3

Baths

2,132

Sq Ft

$206/Sq Ft

Est. Value

About This Home

This home is located at 231 Angela Cir, Oswego, IL 60543 and is currently estimated at $439,032, approximately $205 per square foot. 231 Angela Cir is a home located in Kendall County with nearby schools including Old Post Elementary School, Thompson Jr. High School, and Oswego High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2006

Sold by

Andersen Svend and Andersen Trine M

Bought by

Dutton Michael T and Dutton Michele T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,800

Outstanding Balance

$33,182

Interest Rate

6.68%

Mortgage Type

Stand Alone Second

Estimated Equity

$405,850

Purchase Details

Closed on

Jun 12, 2003

Sold by

Radakovich Stephen A and Radakovich Amy E

Bought by

Andersen Svend and Andersen Trine M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

4.87%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 1, 1996

Bought by

Radakovich Stephen A and Radakovich Amy E

Purchase Details

Closed on

Jun 1, 1995

Bought by

Kimball Hill Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dutton Michael T | $279,000 | Multiple | |

| Andersen Svend | $249,000 | -- | |

| Radakovich Stephen A | $196,000 | -- | |

| Kimball Hill Inc | $760,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dutton Michael T | $55,800 | |

| Open | Dutton Michael T | $223,200 | |

| Previous Owner | Andersen Svend | $150,000 | |

| Closed | Kimball Hill Inc | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,562 | $124,817 | $31,508 | $93,309 |

| 2023 | $8,526 | $110,457 | $27,883 | $82,574 |

| 2022 | $8,526 | $100,415 | $25,348 | $75,067 |

| 2021 | $8,219 | $93,846 | $23,690 | $70,156 |

| 2020 | $8,042 | $91,113 | $23,000 | $68,113 |

| 2019 | $7,919 | $88,494 | $23,000 | $65,494 |

| 2018 | $7,715 | $83,843 | $20,510 | $63,333 |

| 2017 | $7,649 | $80,618 | $19,721 | $60,897 |

| 2016 | $7,597 | $79,037 | $19,334 | $59,703 |

| 2015 | $7,716 | $76,735 | $18,771 | $57,964 |

| 2014 | -- | $74,500 | $18,224 | $56,276 |

| 2013 | -- | $75,252 | $18,408 | $56,844 |

Source: Public Records

Map

Nearby Homes

- 39 Cayman Dr

- 4 Circle Ct

- 47 Old Post Rd

- 19 Wyndham Dr Unit 10

- 73 Ingleshire Rd

- 30 Hampton Rd

- 40 Codorus Rd

- 28 Seneca Dr

- 34 Pembrooke Rd

- 215 Fernwood Rd

- 22 Sherwick Rd

- 9 Cebold Dr

- 29 Briarcliff Rd

- 3 Scarsdale Rd

- 420 Chesterfield Ct Unit 420

- 117 Boulder Hill Pass Unit 117

- 60 Fernwood Rd

- 119 Garden Dr

- 92 Red Fox Run Unit 2

- 140 Autumn Rdg Dr