380 Jeremiah Dr Unit D Simi Valley, CA 93065

West Simi Valley NeighborhoodEstimated Value: $588,878 - $630,000

2

Beds

3

Baths

1,378

Sq Ft

$445/Sq Ft

Est. Value

About This Home

This home is located at 380 Jeremiah Dr Unit D, Simi Valley, CA 93065 and is currently estimated at $612,970, approximately $444 per square foot. 380 Jeremiah Dr Unit D is a home located in Ventura County with nearby schools including Arroyo Elementary School, Sinaloa Middle School, and Royal High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 19, 2017

Sold by

Redmon Marie O

Bought by

Redmon Marie O

Current Estimated Value

Purchase Details

Closed on

May 12, 1999

Sold by

Canling Wu Chaoping Liu

Bought by

Redmon Marie O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,800

Interest Rate

6.9%

Mortgage Type

Balloon

Purchase Details

Closed on

Oct 27, 1994

Sold by

Papanicolaou Constantino

Bought by

Wu Chaoping and Liu Canling

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,440

Interest Rate

9.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Redmon Marie O | -- | None Available | |

| Redmon Marie O | $166,000 | Chicago Title Co | |

| Wu Chaoping | $152,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Redmon Marie O | $132,800 | |

| Previous Owner | Wu Chaoping | $147,440 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,464 | $260,206 | $104,080 | $156,126 |

| 2024 | $3,464 | $255,104 | $102,039 | $153,065 |

| 2023 | $3,266 | $250,102 | $100,038 | $150,064 |

| 2022 | $3,244 | $245,199 | $98,077 | $147,122 |

| 2021 | $3,213 | $240,392 | $96,154 | $144,238 |

| 2020 | $3,144 | $237,929 | $95,169 | $142,760 |

| 2019 | $3,001 | $233,264 | $93,303 | $139,961 |

| 2018 | $2,972 | $228,691 | $91,474 | $137,217 |

| 2017 | $2,905 | $224,208 | $89,681 | $134,527 |

| 2016 | $2,780 | $219,813 | $87,923 | $131,890 |

| 2015 | $2,721 | $216,513 | $86,603 | $129,910 |

| 2014 | $2,696 | $212,273 | $84,907 | $127,366 |

Source: Public Records

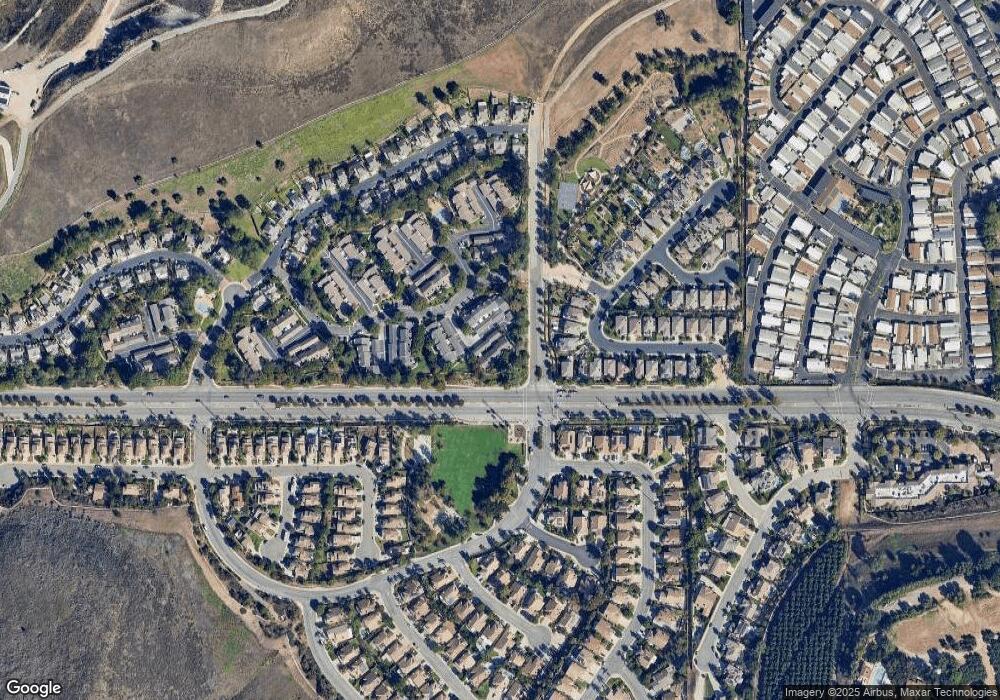

Map

Nearby Homes

- 195 Tierra Rejada Rd Unit 180

- 195 Tierra Rejada Rd Unit 197

- 195 Tierra Rejada Rd Unit 71

- 195 Tierra Rejada Rd Unit 52

- 195 Tierra Rejada Rd Unit 178

- 195 Tierra Rejada Rd Unit 219

- 579 Stoney Peak Ct

- 580 Stoney Peak Ct

- 1880 Winterdew Ave

- 101 Red Brick Dr Unit 5

- 105 Red Brick Dr Unit 2

- 118 Red Brick Dr Unit 1

- 20 Robbins Ct

- 1708 Starpine Way Unit 64

- 1743 Duskwood Way

- 90 La Paz Ct

- 1760 Millpark Ln

- 1100 N Country Club Dr

- 1668 Woodscent Ln

- 1778 Sinaloa Rd Unit 294

- 380 Jeremiah Dr Unit A

- 380 Jeremiah Dr Unit B

- 380 Jeremiah Dr Unit C

- 380 Jeremiah Dr Unit E

- 370 Jeremiah Dr Unit A

- 370 Jeremiah Dr Unit B

- 370 Jeremiah Dr Unit C

- 370 Jeremiah Dr Unit D

- 370 Jeremiah Dr Unit E

- 370 Jeremiah Dr Unit F

- 390 Jeremiah Dr

- 390 Jeremiah Dr Unit F

- 390 Jeremiah Dr Unit E

- 390 Jeremiah Dr Unit D

- 390 Jeremiah Dr Unit C

- 390 Jeremiah Dr Unit B

- 390 Jeremiah Dr Unit A

- 410 Jeremiah Dr Unit E

- 410 Jeremiah Dr Unit D

- 410 Jeremiah Dr Unit C