4910 Rays Cir Unit 4910 Dublin, OH 43016

Tuttle West NeighborhoodEstimated Value: $377,000 - $450,000

3

Beds

3

Baths

2,444

Sq Ft

$168/Sq Ft

Est. Value

About This Home

This home is located at 4910 Rays Cir Unit 4910, Dublin, OH 43016 and is currently estimated at $409,428, approximately $167 per square foot. 4910 Rays Cir Unit 4910 is a home located in Franklin County with nearby schools including Norwich Elementary School, Hilliard Tharp Sixth Grade Elementary School, and Hilliard Weaver Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 24, 2010

Sold by

Houle Thomas F and Houle Terese M

Bought by

Springer Lisa M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$169,125

Outstanding Balance

$111,224

Interest Rate

4.36%

Mortgage Type

New Conventional

Estimated Equity

$298,204

Purchase Details

Closed on

Oct 27, 2005

Sold by

Houle Thomas F and Houle Terese M

Bought by

Houle Thomas F and Houle Terese M

Purchase Details

Closed on

Mar 12, 2004

Sold by

Villas At Rays Crossing Llc

Bought by

Houle Thomas F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$170,000

Interest Rate

5.74%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Springer Lisa M | $225,500 | Attorney | |

| Houle Thomas F | -- | -- | |

| Houle Thomas F | $241,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Springer Lisa M | $169,125 | |

| Previous Owner | Houle Thomas F | $170,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,138 | $121,490 | $21,350 | $100,140 |

| 2023 | $6,626 | $121,485 | $21,350 | $100,135 |

| 2022 | $6,085 | $88,800 | $17,010 | $71,790 |

| 2021 | $6,082 | $88,800 | $17,010 | $71,790 |

| 2020 | $6,066 | $88,800 | $17,010 | $71,790 |

| 2019 | $5,940 | $74,000 | $14,180 | $59,820 |

| 2018 | $5,887 | $74,000 | $14,180 | $59,820 |

| 2017 | $5,918 | $74,000 | $14,180 | $59,820 |

| 2016 | $6,199 | $71,760 | $12,150 | $59,610 |

| 2015 | $5,855 | $71,760 | $12,150 | $59,610 |

| 2014 | $5,865 | $71,760 | $12,150 | $59,610 |

| 2013 | $2,976 | $71,750 | $12,145 | $59,605 |

Source: Public Records

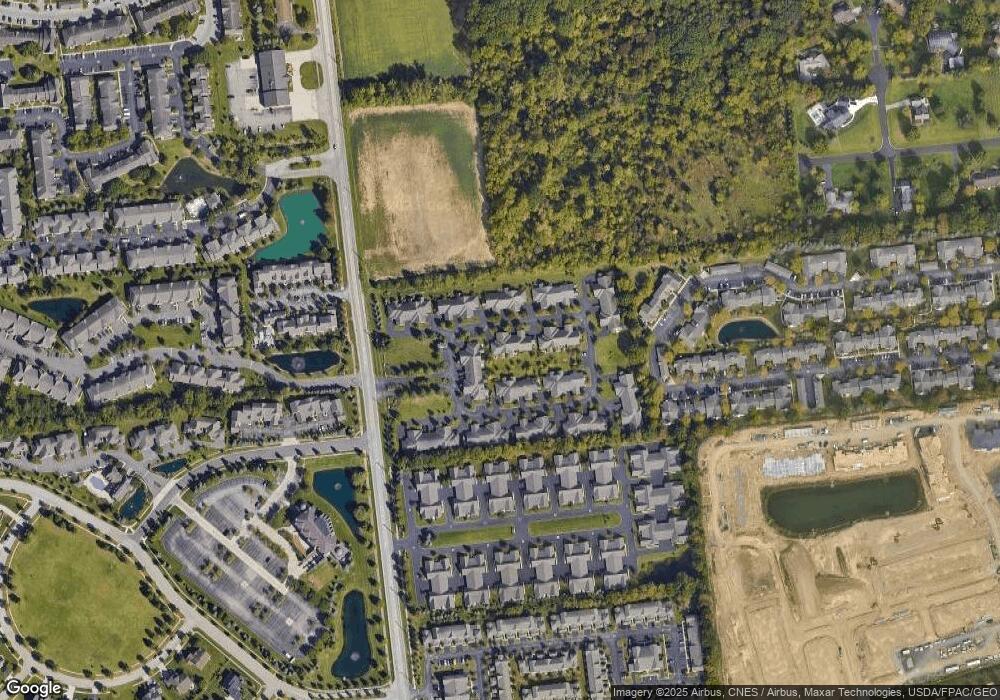

Map

Nearby Homes

- 4827 Rays Cir Unit 4827

- 4801 Rays Cir SW Unit 4801

- 5006 Vinington Place Unit 5006

- 0 Riggins Rd

- 5185 Vinings Blvd Unit 5185

- 5632 Rose of Sharon Dr Unit 5632

- 5744 Caulfield Ln

- 5213 Avery Oak Dr Unit 5213

- 5856 Locbury Ln Unit R

- 5296 Estuary Ln

- 5292 Estuary Ln

- 6228 Rings Rd

- 6258 Cartwright Ln N

- 5444 Carson City Ln

- 5468 Carson City Ln

- 5720 Sandymount Dr

- 5556 Stockton Way

- 6260 Hampton Green Place Unit 16-C

- 5839 Castleknock Rd

- 6259 Hampton Green Place Unit 8B

- 4906 Rays Cir Unit 4906

- 4938 Rays Cir Unit 4938

- 4902 Rays Cir Unit 4902

- 4942 Rays Cir Unit 4942

- 4946 Rays Cir Unit 4946

- 4828 Rays Cir Unit 4828

- 4836 Rays Cir Unit 4836

- 4950 Rays Cir Unit 4950

- 4838 Rays Cir Unit 4838

- 4896 Rays Cir Unit 4896

- 4907 Rays Cir Unit 4907

- 4903 Rays Cir Unit 4903

- 4911 Rays Cir Unit 4911

- 4899 Rays Cir Unit 4899

- 4915 Rays Cir Unit 4915

- 4892 Rays Cir Unit 4892

- 4919 Rays Cir Unit 4919

- 4895 Rays Cir Unit 74895

- 4823 Rays Cir Unit 4823

- 4846 Rays Cir Unit 4846