8024 Hidden View Cir Fair Oaks, CA 95628

Estimated Value: $431,000 - $650,000

3

Beds

2

Baths

1,769

Sq Ft

$317/Sq Ft

Est. Value

About This Home

This home is located at 8024 Hidden View Cir, Fair Oaks, CA 95628 and is currently estimated at $561,173, approximately $317 per square foot. 8024 Hidden View Cir is a home located in Sacramento County with nearby schools including Northridge Elementary School, Andrew Carnegie Middle School, and Bella Vista High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 18, 2024

Sold by

Patamakomol Panya and Patamakomol Nirapa

Bought by

Patamakomol Revocable Living Trust and Patamakomol

Current Estimated Value

Purchase Details

Closed on

Aug 11, 1998

Sold by

Washington Mutual Bank Fa

Bought by

Patamakomol Panya and Patamakomol Nirapa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

6.95%

Purchase Details

Closed on

Nov 9, 1997

Sold by

Estopinal Andrew W and Estopinal Patricia M

Bought by

Washington Mutual Bank Fa and American Svgs Bank Fa

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Patamakomol Revocable Living Trust | -- | None Listed On Document | |

| Patamakomol Panya | $155,000 | Old Republic Title Company | |

| Washington Mutual Bank Fa | $156,522 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Patamakomol Panya | $100,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,894 | $242,969 | $86,208 | $156,761 |

| 2024 | $2,894 | $238,206 | $84,518 | $153,688 |

| 2023 | $2,808 | $233,536 | $82,861 | $150,675 |

| 2022 | $2,796 | $228,958 | $81,237 | $147,721 |

| 2021 | $2,740 | $224,470 | $79,645 | $144,825 |

| 2020 | $2,700 | $222,169 | $78,829 | $143,340 |

| 2019 | $2,631 | $217,814 | $77,284 | $140,530 |

| 2018 | $2,572 | $213,544 | $75,769 | $137,775 |

| 2017 | $2,544 | $209,358 | $74,284 | $135,074 |

| 2016 | $2,378 | $205,254 | $72,828 | $132,426 |

| 2015 | $2,336 | $202,172 | $71,735 | $130,437 |

| 2014 | $2,286 | $198,212 | $70,330 | $127,882 |

Source: Public Records

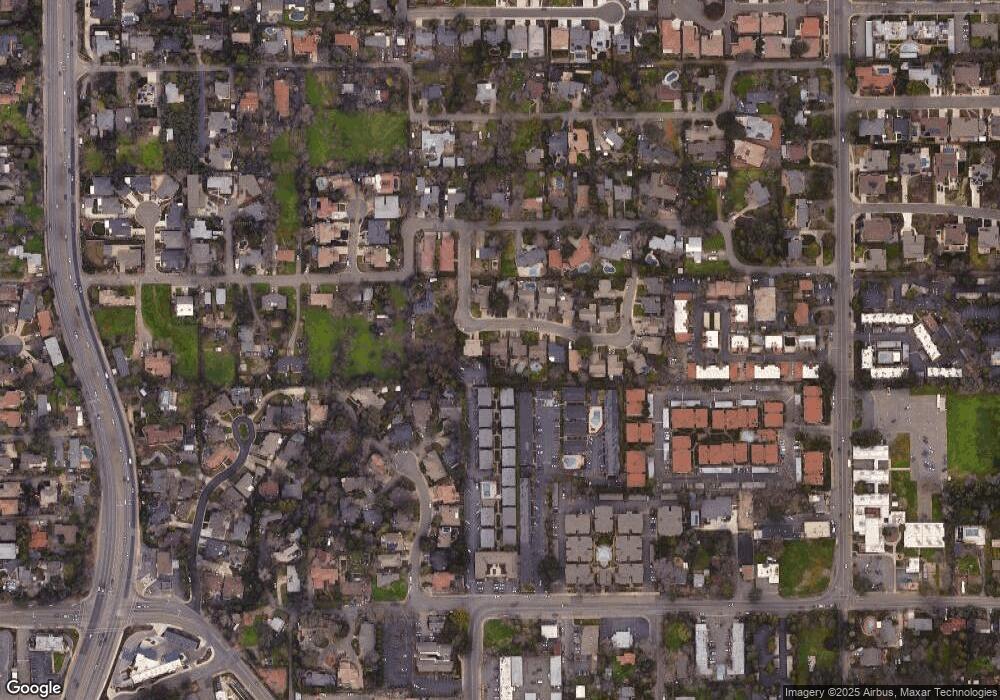

Map

Nearby Homes

- 8053 Sierra St

- 4128 Hill St

- 8200 Shangrila Dr

- 8068 Jaden Ln

- 7841 Lemon St

- 4609 Lei St

- 7786 Winding Way

- 0 Ridge St Unit 225129517

- 0 Ridge St Unit 224054501

- 4922 Rimwood Dr

- 4215 New York Ave

- 3909 Edgevale Ct

- 11330 Fair Oaks Blvd Unit 102A

- 11330 Fair Oaks Blvd Unit 208A

- 4040 Minnesota Ave

- 8218 Finisterre Ct

- 7825 Greenridge Way

- 7818 Tamara Dr

- 5013 Kendra Ct

- 7637 Vasos Way

- 8028 Hidden View Cir

- 8020 Hidden View Cir

- 8032 Hidden View Cir

- 8036 Hidden View Cir

- 8025 Hidden View Cir

- 8021 Hidden View Cir

- 8029 Hidden View Cir

- 4428 Bijan Ct

- 8033 Hidden View Cir

- 8040 Hidden View Cir

- 8002 Orange Ave

- 8037 Hidden View Cir

- 4432 Bijan Ct

- 8041 Hidden View Cir

- 8044 Hidden View Cir

- 8018 Orange Ave

- 10517 Fair Oaks Blvd

- 4424 Bijan Ct

- 8024 Orange Ave

- 8048 Hidden View Cir

Your Personal Tour Guide

Ask me questions while you tour the home.