8814 Mt Sopras Ct Riverside, CA 92508

Orangecrest NeighborhoodEstimated Value: $681,575 - $763,000

3

Beds

2

Baths

2,032

Sq Ft

$351/Sq Ft

Est. Value

About This Home

This home is located at 8814 Mt Sopras Ct, Riverside, CA 92508 and is currently estimated at $713,644, approximately $351 per square foot. 8814 Mt Sopras Ct is a home located in Riverside County with nearby schools including Benjamin Franklin Elementary School, Amelia Earhart Middle School, and Martin Luther King Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2010

Sold by

Katzanek Jack M and Kopp Carol C

Bought by

Katzanek Jack M and Kopp Carol C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$358,098

Outstanding Balance

$246,151

Interest Rate

5.5%

Mortgage Type

FHA

Estimated Equity

$467,493

Purchase Details

Closed on

Sep 25, 2008

Sold by

Christensen Jon E

Bought by

Katzanek Jack M and Kopp Carol C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$351,600

Interest Rate

5.77%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 13, 2003

Sold by

Woodside Autumn Ridge Inc

Bought by

Christensen Jon E and The Clyde & Eileen J Christensen Family

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Katzanek Jack M | -- | Accommodation | |

| Katzanek Jack M | $358,000 | First American Title Company | |

| Christensen Jon E | $160,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Katzanek Jack M | $358,098 | |

| Closed | Katzanek Jack M | $351,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,002 | $461,000 | $115,886 | $345,114 |

| 2023 | $5,002 | $443,101 | $111,387 | $331,714 |

| 2022 | $4,888 | $434,413 | $109,203 | $325,210 |

| 2021 | $4,823 | $425,896 | $107,062 | $318,834 |

| 2020 | $4,787 | $421,530 | $105,965 | $315,565 |

| 2019 | $4,697 | $413,266 | $103,888 | $309,378 |

| 2018 | $4,606 | $405,163 | $101,852 | $303,311 |

| 2017 | $4,524 | $397,219 | $99,855 | $297,364 |

| 2016 | $4,233 | $389,432 | $97,898 | $291,534 |

| 2015 | $4,092 | $376,000 | $95,000 | $281,000 |

| 2014 | $3,781 | $338,000 | $85,000 | $253,000 |

Source: Public Records

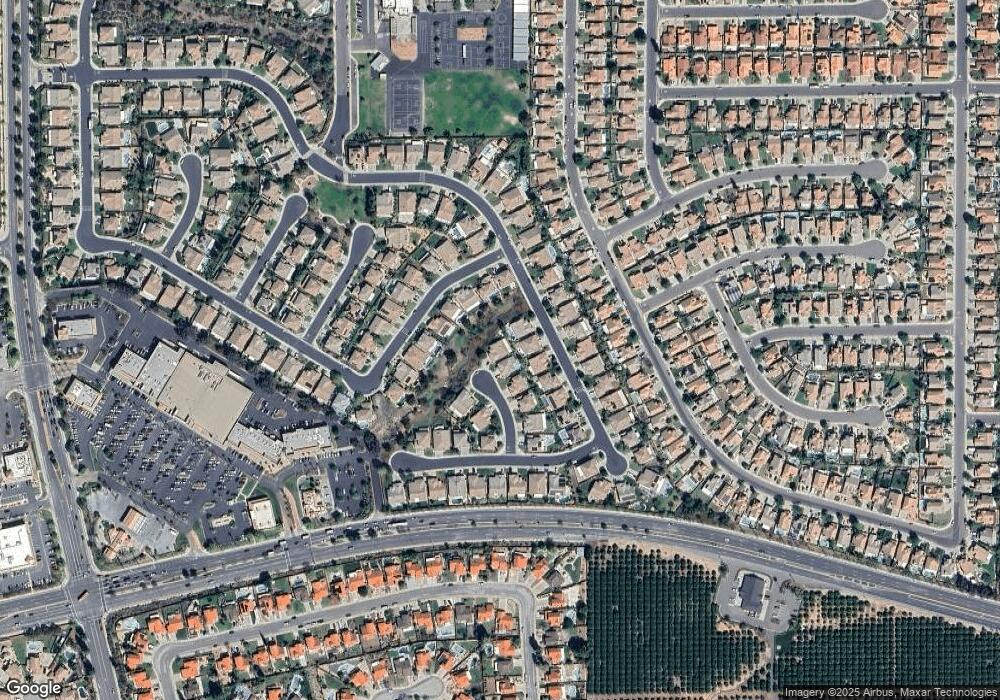

Map

Nearby Homes

- 0 Old Frontage Rd Unit OC25137111

- 0 Apn#267-180-003 Unit CV22145370

- 8679 Cabin Place

- 8489 Syracuse St

- 19458 Hebron Ct

- 20101 Sedona Dr

- 8873 Gumtree Ln

- 8751 Rosebay Ct

- 19420 Lambeth Ct

- 19202 Bergamont Dr

- 19126 Marmalade Ct

- 8962 Morning Hills Dr

- 0 Barton St

- 19883 San Juan Capistrano Ct

- 9228 Whiting Way

- 19791 Paso Robles Dr

- 9244 Whiting Way

- 20241 Edmund Rd

- 9220 Village Way

- 19510 Fortunello Ave

- 8830 Mt Sopras Ct

- 19726 Mt Wasatch Dr

- 19718 Mt Wasatch Dr

- 8846 Mt Sopras Ct

- 19734 Mt Wasatch Dr

- 19742 Mt Wasatch Dr

- 8728 Snowmass Peak Way

- 8862 Mt Sopras Ct

- 8738 Snowmass Peak Way

- 8748 Snowmass Peak Way

- 8845 Mt Sopras Ct

- 8758 Snowmass Peak Way

- 8708 Snowmass Peak Way

- 8875 Mt Sopras Ct

- 19750 Mt Wasatch Dr

- 8768 Snowmass Peak Way

- 19725 Mt Wasatch Dr

- 8878 Mt Sopras Ct

- 19733 Mt Wasatch Dr

- 19717 Mt Wasatch Dr