Headlines on the jobs data released this week painted a gloomy picture of conditions in the labor market, with the unemployment rate reaching its highest level in more than four years (and its highest non-COVID level since early 2017). That has some economy-watchers optimistic that interest rates for mortgages and other loans will ease.

Those hopes, though, may be misplaced.

The Federal Reserve cut its policy interest rate target earlier this month precisely to guard against weakness in the labor market. Fed Chairman Jerome Powell, however, warned that further rate cuts may be inappropriate because inflation remains too high and cutting interest rates again could push it up even more. Another data release this week, though, showed a decline in inflation: The all-item Consumer Price Index increased by just 2.7% over the year ending November 2025, the lowest year-over-year inflation reading since July.

In short, the headlines this week combined labor market weakness with lower inflation, a pairing that often portends a recession and prompts the Fed to cut its rate further.

Does that mean either that a recession is looming or that prospective homebuyers can expect to benefit from lower mortgage rates? Not necessarily.

Labor market is healthier than it seems

When you dig deeper into the job numbers, many of them don’t look nearly as bad as the high unemployment rate does. For example, a small part of the reason that the unemployment rate increased is that some people who were not actively looking for a job have started to do so — a trend that is generally taken as a sign of a sturdy labor market, not a faltering one. In fact, the employment-to-population ratio — that is, the share of people aged 16 years or older who have a job — actually nudged up a tick.

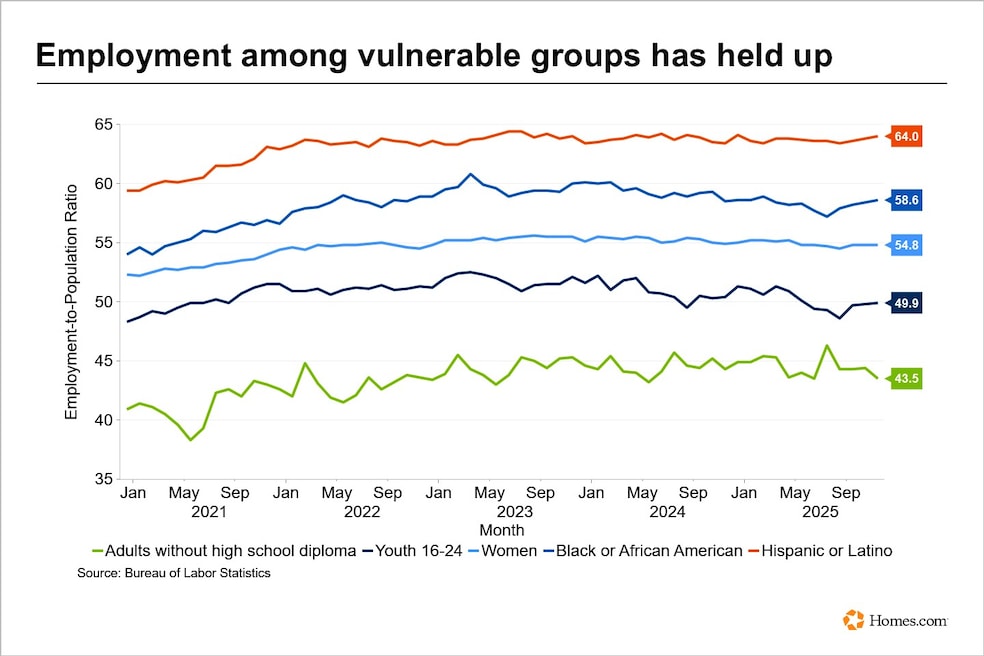

Certain vulnerable groups of workers are typically the first to lose their jobs when the labor market is really hurting. Three of those groups, though, are showing no signs of a downturn:

- At the end of 2024, 64.1% of Hispanic adults held jobs; in November, the proportion remained at 64%, practically unchanged

- Among Black adults, the proportion remained the same, at 58.6%

- Among adult women, the proportion declined by just two-tenths of a percentage point from 55% to 54.8%, well within the range of statistical uncertainty.

Only two of those vulnerable groups seem to have been losing jobs during 2025: The share of youths and young adults (ages 16 to 24) who have jobs declined from 51.3% to 49.9%, and the percentage of adults with less than a high school diploma who have jobs decreased from 44.9% to 43.5%.

In an even more unmistakable sign of economic resilience, the average earnings for all private-sector workers (per hour or per week) have increased by 3.5% over the past 12 months. That means earnings growth has exceeded the inflation rate over the past year, so workers have gained purchasing power.

Consumer spending is key to being recession-free

The economy is unlikely to slip into a recession if consumer spending remains strong, and a separate report this week suggested that’s exactly what is happening: Spending at retail and food services stores increased by 3.5% from October 2024 to October 2025. (The growth was 4% not counting motor vehicles and parts, a segment in which the expiration of a federal tax credit hurt spending.)

As with earnings, the growth in retail spending has been far greater than the rate of inflation, meaning that consumers not only spent more money but also purchased more goods and services, which helps propel the economy.

Of course, not everyone has seen their earnings increase at a rate greater than the cost of living, nor has everyone been able to absorb higher prices and still purchase more goods and services. The Federal Reserve, though, cannot target its interest rate policy to help those households that most need assistance; it needs to look at the economy as a whole.

Some buyers are waiting for rates to fall

Because the overall economy has remained resilient while inflation remains too high, there is no guarantee that interest rates will decline further.

One last piece of information this week, however, suggested that prospective homebuyers may not need lower mortgage interest rates to achieve their goal. A monthly survey by the National Association of Home Builders reported that 40% of builders of single-family homes cut their prices this month, by an average of 5%, after 41% had reported doing so in November by an average of 6%.

Despite those price cuts by new-home builders and an increase in the inventory of properties available for purchase, Homes.com’s data showed a sharp decline in the overall number of sales in November. Some prospective buyers may have been hoping that mortgage interest rates would continue to decline if they waited longer before buying their home.

The economic data released this week, however, makes that strategy an uncertain one.