Senators want to regulate cryptocurrency, but the use of digital money raises concerns about security and volatility when it comes to real estate sales.

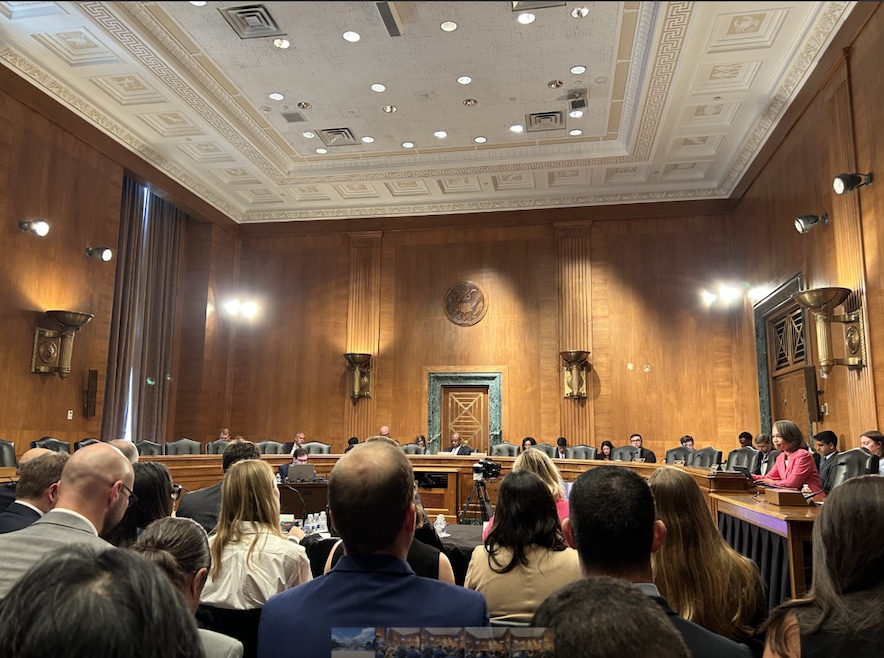

The U.S. Senate Committee on Banking, Housing, and Urban Affairs met Wednesday for a panel discussion titled "From Wall Street to Web3: Building Tomorrow's Digital Asset Markets."

Six panelists weighed in with ideas and concerns: Blockchain Association CEO Summer Mersinger, Chainanalysis CEO Jonathan Levin, Paradigm general partner Dan Robinson, Ripple CEO Brad Garlinghouse, University of Minnesota Law School professor Richard Painter and Timothy Massad, a research fellow at the Kennedy School of Government at Harvard University.

All agreed that cryptocurrency is gaining popularity, but regulation is needed to prevent domestic and international fraud.

The discussion follows Federal Housing Finance Agency Director Bill Pulte's push for widespread use of cryptocurrency in mortgage lending. In early July, Pulte directed mortgage finance giants Fannie Mae and Freddie Mac to consider cryptocurrency a financial asset in applications.

"The conversations are happening now because they are frankly overdue," said Gina Pieters, founder of Chicago-based Digital Economy Research & Consulting, who attended the discussion. "They need to happen now to ensure the United States is in equal standing with many countries in the rest of the world."

The panel discussion focused on general ideas but Painter and Massad told Homes.com that cryptocurrency could be used safely in the residential market — with oversight at the state and federal levels.

"I am concerned. It could be done [safely], we just need experienced regulators to look at this," Painter said. "It depends on the particular cryptocurrency involved. Some cryptocurrencies, such as stablecoins, are tied to a specific asset, and that’s a lot safer than cryptocurrency that has a lot of price fluctuations."

Massad said cryptocurrency and digital processes can play a role beyond real estate transactions, including using blockchain to keep real estate records and minimize some of the costs involved in maintaining those records and doing title searches.

"One could imagine tokenizing securities that represent mortgages, but we need the framework of regulation that we don’t have today to do that," Massad said.