Housing affordability woes hampering the nation's housing market aren't getting any better, new figures show.

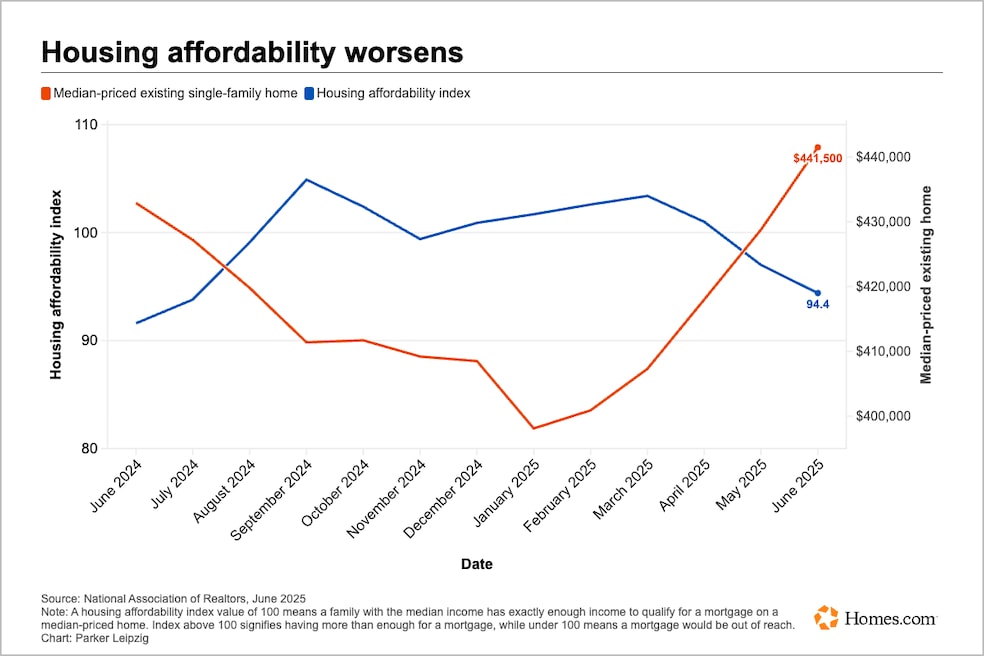

The National Association of Realtors' Housing Affordability Index for June was 94.4. That's the lowest reading since July 2024 and the first time it dropped below 100 since November.

The index measures whether a family with the median income has enough money to qualify for a mortgage on a median-priced home of $441,500. A reading above 100 means the family has more than enough income for that mortgage and under 100 means the mortgage is out of reach.

While home price growth is slowing nationally, it's still trending upward in most areas while mortgage rates remain elevated. In June, the weekly average for a 30-year, fixed-rate mortgage ranged from 6.86% to 6.99%, according to mortgage giant Freddie Mac.

"Incomes are still struggling to catch up with both price and rates," Ken Johnson, the Walker Family Chair of Real Estate at the University of Mississippi, told Homes.com.

The traditional spring selling season has been a disappointment as buyers cite affordability concerns, homebuilders say.

California's housing affordability is mired near historic lows. To entice buyers in the Golden State and across the country, builders are offering concessions such as price cuts and mortgage-rate buy-downs. In a buydown, builders take profits to lower borrowing costs and make monthly payments more affordable.

"Sales are all about confidence with the consumer in today's environment," Taylor Morrison CEO and Chairman Sheryl Palmer said on a conference call last month. "We do know that buyers want a deal."

Also, with mortgage rates moderating in recent weeks, that could boost NAR's affordability index readings in the near future closer to or over 100, Johnson said.

"Affordability is likely to improve by year end, but will remain historically constrained," Odeta Kushi, deputy chief economist at financial services firm First American, wrote in a blog post last week.