The number of residential remodeling firms in the United States has reached new heights, far outpacing the number of single-family homebuilders. As homeowners face economic uncertainty and curb spending, however, that trend could change.

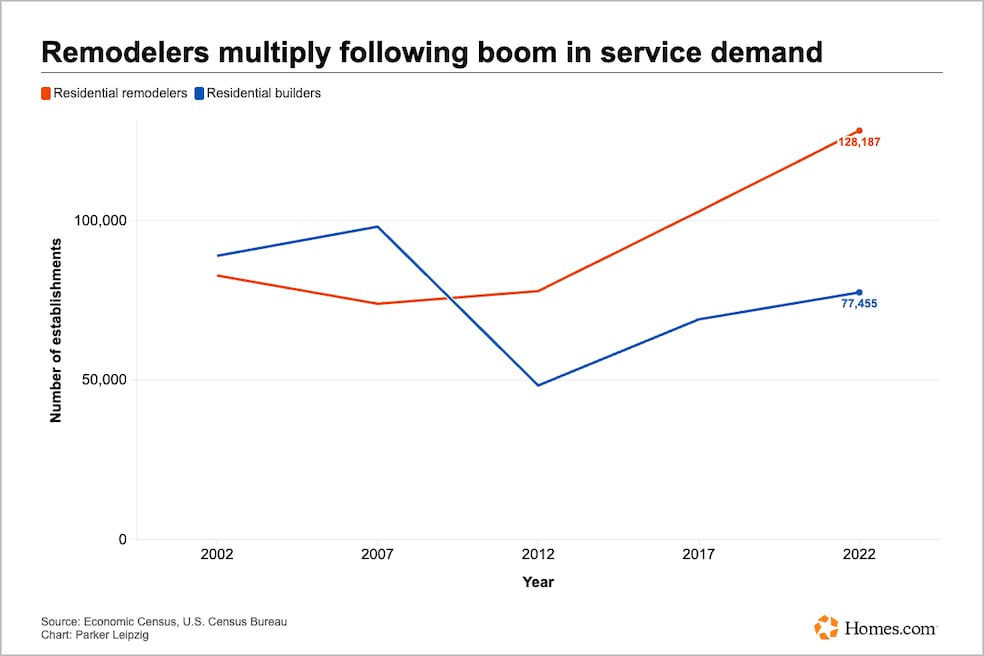

There are about 128,187 residential remodeling firms and 77,455 residential builders in the country, according to analysis from the National Association of Home Builders. The Washington, D.C.-based trade group analyzed data from the U.S. Census Bureau’s 2022 Economic Census, which comes out every five years. The next report is slated for release in 2027. The Census Bureau defines remodeling firms as “establishments primarily responsible for ... additions, alterations, reconstruction, maintenance, and repairs of residential buildings.”

That chasm, which amounts to about 65% more remodelers than single-family and multifamily builders combined, represents a notable growth spurt for the residential remodeling industry. The number of remodeling businesses increased 25% between the 2017 and 2022 censuses, more than double the 12% growth in builder establishments.

Remodeling firms have been growing in number since 2007. That’s also the last census year in which builders actually outnumbered remodelers, making up 57% of the combined share of such work.

Given patterns of homeowner spending over the past decade, the exponential growth in remodeling firms isn’t surprising. According to March 2025 analysis from the Joint Center for Housing Studies of Harvard University, U.S. spending on remodeling skyrocketed following the onset of the COVID-19 pandemic. The crisis left many homebound, arming some owners with spare time as they faced the reality — and potential — of their own spaces. Remodeling spending surged, surpassing $600 billion in 2022.

Although remodeling spending dipped in 2023 and 2024, the levels remained comfortably above pre-pandemic numbers, the JCHS noted in its report, even as homeowners have seen increasingly uncertain economic conditions.

“Many owners continue to adapt their properties for changing needs and uses, even as today’s lower rates of personal savings and household mobility dampen improvement and repair spending,” the report stated.

Growth in remodeling spending could contract in 2026

However, recent spending predictions published by the JCHS in July complicate the remodeling picture in the U.S.

Based on its Leading Indicator of Remodeling Activity, “annual expenditures for improvements and maintenance to owner-occupied homes are expected to soften in 2026,” according to a press release from the center.

If homeowners pull back as anticipated, renovation and repair spending could post growth of just 1.2% in the second quarter of 2026. And, while cooling spending alone won’t send remodeler numbers tumbling anytime soon, it could suggest a narrowing gap between the number of new residential remodelers and builders by the time 2027 rolls around.