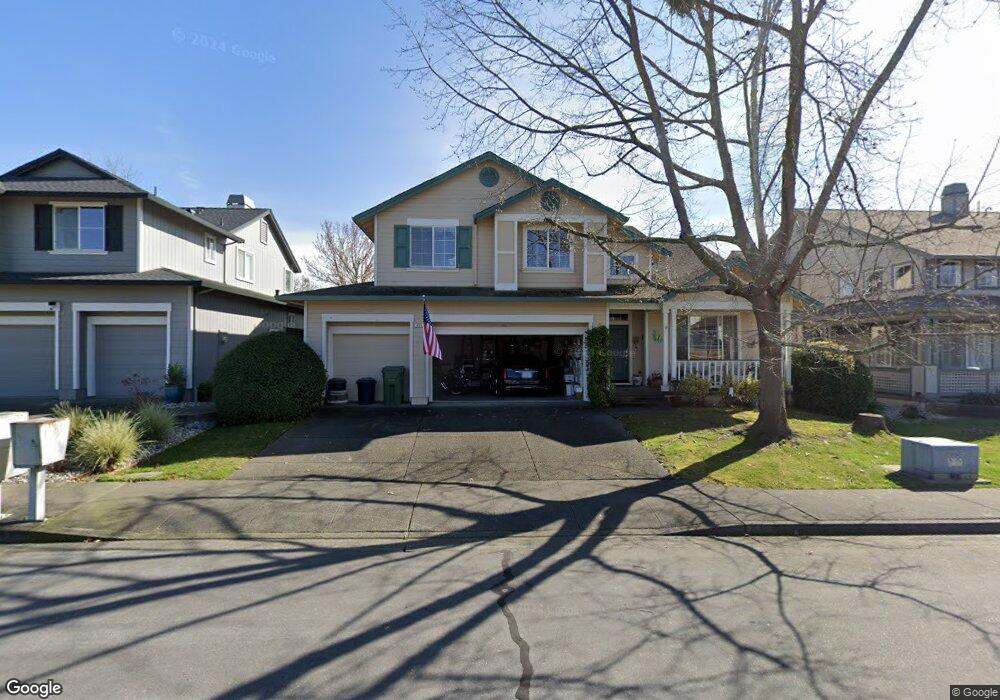

425 Christopher Way Windsor, CA 95492

Estimated Value: $881,000 - $976,000

5

Beds

3

Baths

2,595

Sq Ft

$361/Sq Ft

Est. Value

About This Home

This home is located at 425 Christopher Way, Windsor, CA 95492 and is currently estimated at $937,997, approximately $361 per square foot. 425 Christopher Way is a home located in Sonoma County with nearby schools including Brooks Elementary School, Mattie Washburn Elementary School, and Windsor Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 12, 2003

Sold by

Weagle William C and Weagle Elizabeth L

Bought by

Weagle William C and Weagle Elizabeth L

Current Estimated Value

Purchase Details

Closed on

Sep 10, 1998

Sold by

Frandsen Jeffrey J and Frandsen Lori A

Bought by

Milazzo Pilar P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$248,000

Outstanding Balance

$39,891

Interest Rate

3.95%

Estimated Equity

$898,106

Purchase Details

Closed on

Dec 16, 1994

Sold by

Arata Estates Investors

Bought by

Frandsen Jeffrey J and Frandsen Lori A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$227,250

Interest Rate

5.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weagle William C | -- | -- | |

| Milazzo Pilar P | $310,000 | Old Republic Title | |

| Frandsen Jeffrey J | $252,500 | North Bay Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Milazzo Pilar P | $248,000 | |

| Previous Owner | Frandsen Jeffrey J | $227,250 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,920 | $485,982 | $125,409 | $360,573 |

| 2024 | $5,920 | $476,453 | $122,950 | $353,503 |

| 2023 | $5,920 | $467,112 | $120,540 | $346,572 |

| 2022 | $5,706 | $457,954 | $118,177 | $339,777 |

| 2021 | $5,615 | $448,975 | $115,860 | $333,115 |

| 2020 | $5,736 | $444,372 | $114,672 | $329,700 |

| 2019 | $5,728 | $435,660 | $112,424 | $323,236 |

| 2018 | $5,646 | $427,119 | $110,220 | $316,899 |

| 2017 | $5,595 | $418,745 | $108,059 | $310,686 |

| 2016 | $5,249 | $410,536 | $105,941 | $304,595 |

| 2015 | $5,107 | $404,370 | $104,350 | $300,020 |

| 2014 | $5,030 | $396,450 | $102,306 | $294,144 |

Source: Public Records

Map

Nearby Homes

- 207 Othello Ct

- 129 Wooded Glen Ct

- 9453 Jessica Dr

- 10845 Rio Ruso Dr

- 100 Wooded Glen Ct

- 9821 Dawn Way

- 411 Walten Way

- 105 Zapata Ct

- 849 Patti Page Ct

- 985 Gumview Rd

- 933 Bond Place

- 9551 Old Redwood Hwy

- 8185 Old Redwood Hwy

- 9131 Benny Goodman Way

- 772 Mcclelland Dr Unit U11

- 191 Johnson St

- 185 Johnson St

- 125 Johnson St

- 202 Johnson St Unit U14

- 913 Turnberry Ct

- 431 Christopher Way

- 419 Christopher Way

- 391 Pollard Way

- 389 Pollard Way

- 393 Pollard Way

- 413 Christopher Way

- 437 Christopher Way

- 385 Pollard Way

- 397 Pollard Way

- 428 Christopher Way

- 9543 Ashley Dr

- 383 Pollard Way

- 399 Pollard Way

- 9522 Camelot Dr

- 407 Christopher Way

- 381 Pollard Way

- 9545 Ashley Dr

- 9524 Camelot Dr

- 316 Dominic Ct

- 501 Christopher Way

Your Personal Tour Guide

Ask me questions while you tour the home.